In the world of financial markets, traders are constantly seeking tools and strategies that can provide them with an edge in making profitable decisions. One such tool that has gained popularity among traders is Donchian Channels. Donchian Channels are a technical indicator that can be particularly useful for identifying trends and breakouts in various financial instruments. In this article, we will explore what Donchian Channels are, how to set them up, and most importantly, how to use them to enhance your trading strategies.

Understanding Donchian Channels

Before we dive into using Donchian Channels for trading trends and breakouts, let’s start by understanding what Donchian Channels are and how they work.

What Are Donchian Channels?

Donchian indicator is a type of technical indicator that was developed by Richard Donchian, a pioneer in the field of technical analysis. Donchian Channels consist of three lines:

- Upper Band: This is the highest high over a specified period.

- Lower Band: This is the lowest low over the same specified period.

- Middle Band: This is the average of the upper and lower bands.

Donchian Channels are typically used to visualize the price’s trading range over a specified period. They help traders identify key price levels, which can be used to make informed trading decisions.

Setting up Donchian Channels

Now that we understand what Donchian Channels are, let’s move on to setting them up for our trading analysis.

How to Add Donchian Channels to Your Trading Platform

Adding Donchian Channels to your trading platform is usually straightforward, as most trading platforms offer this indicator as a built-in option. Here’s a general guide on how to add Donchian Channels:

- Open your trading platform.

- Go to the indicator or studies menu.

- Search for “Donchian Channels” or a similar name.

- Select the indicator and add it to your chart.

Choosing the Appropriate Time Frame and Period

Selecting the right time frame and period for your Donchian Channels is crucial for effective analysis. The time frame refers to the chart interval you’re using (e.g., daily, hourly, 15-minute), while the period (or look-back) determines how many bars or candles are considered in the calculation of the channels.

- For shorter-term trading, you might use a 20-hour Donchian Channel on an hourly chart.

- For longer-term investing, a 20-week Donchian Channel on a weekly chart might be more suitable.

The choice of time frame and period will depend on your trading strategy and goals. Shorter periods can help identify short-term trends and breakouts, while longer periods are better for capturing longer-term trends.

Trading with Donchian Channels

Now that you have set up Donchian Channels, let’s explore how to use them effectively for trading trends and breakouts.

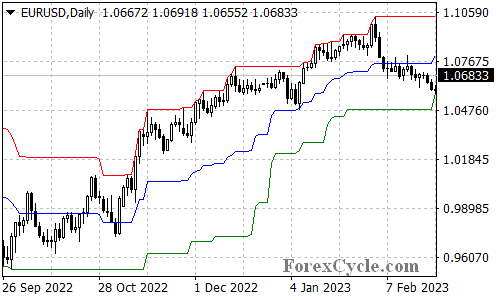

Using Donchian Channels to Identify Trends

Donchian Channels can be invaluable for recognizing trends. You can identify an uptrend when the price consistently stays near or above the upper band of the channel. Conversely, a downtrend is evident when the price hovers near or below the lower band of the channel.

Identifying an Uptrend:

- The price consistently remains near or above the upper band.

- The middle band is sloping upwards.

- Higher highs and higher lows are visible on the price chart.

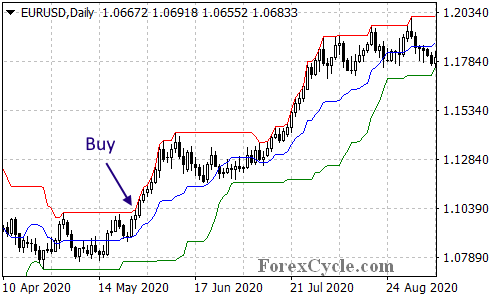

When these conditions are met, it suggests the presence of an uptrend. Traders often look for opportunities to buy or enter long positions in this scenario.

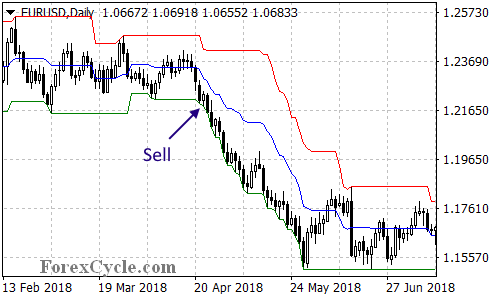

Identifying a Downtrend:

- The price consistently stays near or below the lower band.

- The middle band is sloping downwards.

- Lower highs and lower lows are evident on the price chart.

When these conditions are present, it indicates a downtrend. Traders typically seek opportunities to sell or enter short positions in a downtrend.

Using Donchian Channels to Spot Breakouts

Breakouts occur when the price moves outside of the Donchian Channel boundaries, indicating a potential trend reversal or the initiation of a new trend. Breakouts can be either bullish (price moves above the upper band) or bearish (price drops below the lower band).

Determining Entry and Exit Points in a Trade

Once you’ve identified a trend or a breakout using Donchian Channels, the next step is determining when to enter and exit a trade.

Strategies for Entering a Trade:

- Breakout Entry: Enter a trade when the price breaks out of the Donchian Channel in the direction of the trend. For example, if it’s an uptrend, you would buy when the price moves above the upper band.

- Pullback Entry: In an established trend, look for temporary pullbacks to the middle band as potential entry points. This strategy allows you to enter a trade at a better price within the overall trend.

Strategies for Exiting a Trade:

- Take Profit: Set a predetermined price level at which you’ll exit the trade to lock in profits.

- Stop Loss: Place a stop-loss order to limit potential losses in case the trade goes against you. The placement of the stop-loss can be based on volatility and should be positioned below the lower Donchian Channel for long trades and above the upper channel for short trades.

Risk Management

Effective risk management is essential when using Donchian Channels or any trading strategy. Don’t forget that no strategy is foolproof, and there is always a risk of loss in trading.

Importance of Risk Management

Risk management helps protect your capital and prevent significant losses. Some key aspects of risk management when using Donchian Channels include:

- Setting Stop-Loss and Take-Profit Orders: These orders are vital for limiting potential losses and securing profits at predetermined levels.

- Position Sizing: The size of your position should be determined by the level of risk you’re willing to take, which is influenced by the volatility of the asset you’re trading.

- Diversification: Avoid putting all your capital into a single trade. Diversifying your trades across different assets can help spread risk.

Real-World Examples

To better understand how Donchian Channels can be applied in real-world trading scenarios, let’s explore a couple of examples.

Example 1: Identifying an Uptrend

Suppose you are analyzing the daily chart of a stock and notice that the price has consistently remained above the upper band of the 20-day Donchian Channel. The middle band is sloping upwards, and the stock is forming higher highs and higher lows. This suggests a strong uptrend. As a trader, you might consider entering a long position in anticipation of further price appreciation.

Example 2: Recognizing a Breakout

You are monitoring a cryptocurrency on a 15-minute chart and notice that the price has been consolidating within the Donchian Channel for an extended period. Suddenly, the price breaks above the upper band with strong momentum. This breakout indicates a potential bullish trend. Traders might take advantage of this breakout to enter a long position, anticipating further price gains.

Common Mistakes to Avoid

While Donchian Channels can be a valuable tool, it’s important to be aware of common mistakes that traders often make when using them.

Common Mistakes:

- Over-Reliance: Relying solely on Donchian Channels without considering other factors can lead to poor decision-making. Always use them in conjunction with other technical and fundamental analysis.

- Ignoring Volatility: Failing to adapt your position sizing and risk management to the asset’s volatility can result in excessive losses.

- Chasing Breakouts: Don’t chase every breakout; make sure to validate them with other technical and fundamental indicators.

- Neglecting the Overall Market: Be aware of broader market conditions and news events that may impact your trades.

Advantages and Limitations of Donchian Channels

As with any trading tool, Donchian Channels have both advantages and limitations.

Advantages of Donchian Channels:

- Simplicity: Donchian Channels are easy to understand and use, making them suitable for traders of all experience levels.

- Trend Identification: They are effective at identifying trends and breakouts.

- Objective Decision-Making: Donchian Channels provide objective criteria for making trading decisions.

Limitations of Donchian Channels:

- Lagging Indicator: Donchian Channels can lag behind price movements, potentially causing late entries and exits.

- Whipsaws: In choppy or sideways markets, Donchian Channels may generate false signals or whipsaws.

- Not a Standalone Solution: They should be used in conjunction with other analysis and not relied upon as the sole indicator.

Conclusion

Donchian Channels can be a valuable addition to your trading toolkit, helping you identify trends and breakouts with clarity. By understanding the components of Donchian Channels, setting them up correctly, and following effective strategies for trading with them, you can improve your trading decisions and better manage risk. Remember that while Donchian Channels are a powerful tool, they should be used in combination with other analysis methods for a more comprehensive trading approach. Start practicing with Donchian Channels on your preferred trading platform, and remember that successful trading requires continuous learning and practice.

Incorporating Donchian Channels into your trading strategy can provide you with valuable insights and enhance your ability to make informed decisions in the ever-changing world of financial markets. Whether you are a novice or an experienced trader, the use of Donchian Channels can contribute to your trading success.