As traders explore the vast array of tools available to them, one common question arises: which moving average is better? The Simple Moving Average (SMA) or the Exponential Moving Average (EMA)? In this article, we will compare these two popular indicators and shed light on their similarities and differences. While they may have distinct characteristics, it is essential to understand that the choice of moving average alone is unlikely to determine trading success. Let’s delve into the topic and gain a better understanding of these moving averages.

Comparing SMA and EMA:

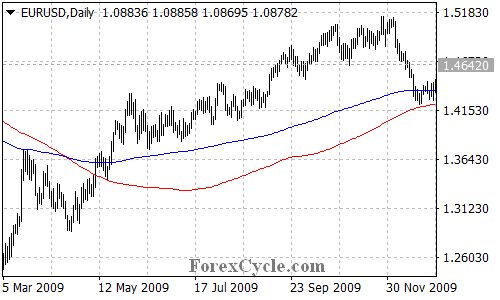

To illustrate the comparison, let’s examine a daily chart of the EUR/USD, with a 200-day SMA (red line) and a 200-day EMA (blue line) plotted. Visually, we can observe that both moving averages closely follow the market trends. The EMA tends to react more quickly to recent price changes due to its emphasis on recent activity. However, in this particular case, the difference between the two is minimal.

Finding the Right Moving Average:

New traders often experiment with both SMA and EMA to determine which one suits their trading approach. However, it is crucial to recognize that switching from one moving average to another is unlikely to transform a losing strategy into a winning one. If such a switch yields positive results, it is more likely that the trading strategy itself needs adjustment rather than the moving average. The impact of the choice between SMA and EMA on strategy outcomes is generally insignificant. Therefore, it is essential to focus on refining the overall trading approach rather than relying solely on the moving average.

Identifying Trends:

The 200-day SMA is widely used for trend identification. When the market is above the 200-day SMA and moving upward, the trend is considered bullish. Conversely, when the market is below the SMA and moving downward, the trend is considered bearish. This simple rule helps traders gauge the overall market direction and make informed decisions.

Short-Term Traders and the 10-day EMA:

Some famous traders have popularized the use of the 10-day EMA among short-term traders. While this moving average may have gained recognition due to its association with successful traders, it is important to remember that the effectiveness of a moving average depends on its ability to support your trading decisions. Ultimately, the judge of which moving average to use should be your account balance from month to month. If a particular moving average enhances your trading performance, it is worth keeping. Conversely, if it does not contribute positively, it may be wise to explore alternatives.

Conclusion:

When it comes to choosing between the Simple Moving Average (SMA) and the Exponential Moving Average (EMA), there is no definitive answer. Both moving averages have their merits, but their impact on trading outcomes is typically minimal. It is far more crucial to focus on developing a robust trading strategy that incorporates multiple indicators and factors into consideration. The choice of moving average should be based on its ability to support your trading decisions and improve your overall performance. Remember, successful trading is a result of comprehensive analysis, risk management, and continuous refinement of your approach.