Visa (V) trades near its 52-week high of $375.51. Its market cap stands at $663.8 billion, reflecting strong investor confidence. With a P/E ratio of 33.63 and a modest 0.69% dividend yield, Visa remains a premium growth stock. The company’s global dominance and tech-driven strategy continue to attract long-term investors.

In Q3 2025, Visa posted $10.2 billion in revenue, up 14% year-over-year. EPS beat estimates at $2.98, marking four straight quarters of surprises. Analysts rate it a strong buy, with targets as high as $430. Visa’s investments in AI, cybersecurity, and blockchain reinforce its leadership. Despite regulatory risks, its forward P/E of 27.79 suggests room for upside.

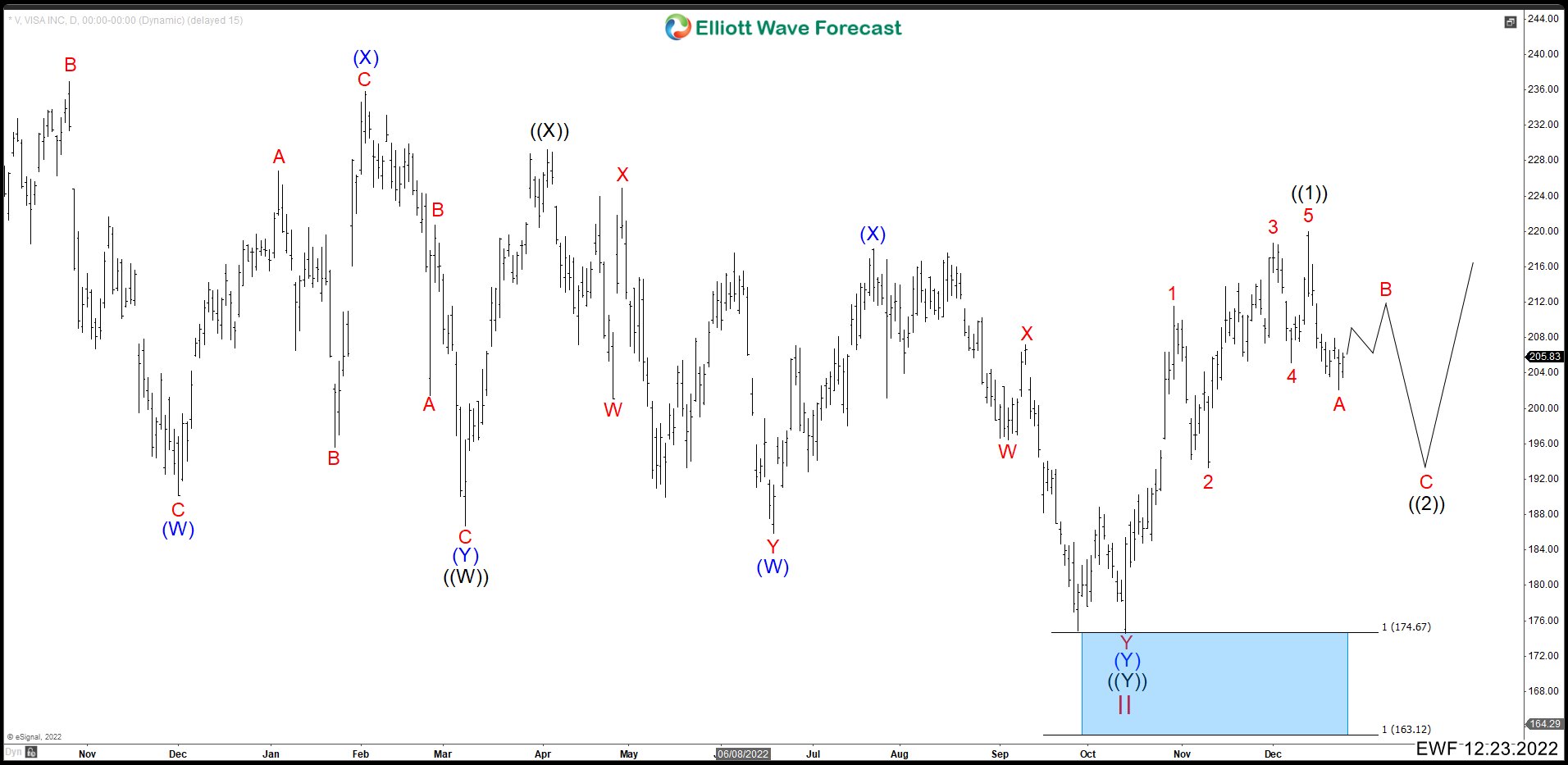

Elliott Wave Outlook: VISA (V) Daily Chart December 2022

Back in October 2022, Visa (V) hit the blue box at $174.60, completing wave ((Y)) of II and setting the stage for a bullish reversal. At the time, we anticipated a leading diagonal to unfold as wave ((1)), and the market delivered exactly that ending the structure at $220.04 high. We were expecting a pullback in 3 swings at least to end wave ((2)) before resuming the rally. This structure confirmed our forecast and reinforced the reliability of the blue box strategy. You can check the old article here: VISA (V) Completed A Double Correction And Rally

Elliott Wave Outlook: VISA (V) Weekly Chart August 2025

In this update, we use the weekly chart of Visa (V) to show that Blue Boxes are not just marketing, they’re high-frequency zones where the market often reacts, and we aim to participate in those reactions. We can see the stock continued building an impulse structure from the blue box area. While alternate counts exist, we believe this one has the highest probability. As long as price stays above $328.70, we expect the rally to continue toward $386.57–$404.48, where wave ((5)) of III should complete. In that zone, we anticipate a bearish reaction that signals the start of wave IV, which should drop to $328.70 before wave V resumes higher. However, if price breaks below $328.70 soon, wave III is likely complete, and wave IV is already in progress. In that case, wave IV should fall to $298.75 before the next bullish leg in wave V.

Source: https://elliottwave-forecast.com/stock-market/visa-v-surges-blue-box-elliott-wave-success/