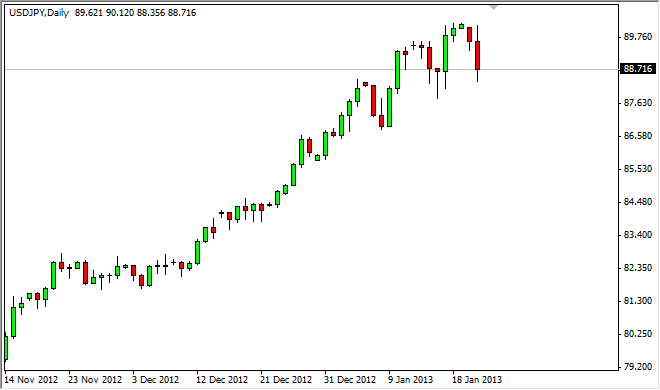

The USD/JPY pair fell during the session on Tuesday, after the Bank of Japan announced its plans for monetary easing. It wasn’t really a matter of being disappointed, more of a “sell on the news” type of move that the markets did. With one-way trade that we’ve seen recently, it makes sense that this pair would give back a little bit of the gains, but now we should continue higher overall. The real question is finding the right support area in which to do so.

A currently looks like the 88.50 level is the first serious attempt for support in this market. The Wednesday hammer from last week should be somewhat supportive going forward. If we managed to break below that, there is a good chance that we will see support at the 88 handle as well. After all, there is a massive amount of buying going on in this pair, and most traders recognize this as a potential trend changing move. With this in mind, a lot of traders are very profitable in their positions right now, and certainly aren’t ready to jump back out.

The Bank of Japan should continue to ease its monetary policy and essentially “print Yen” for the foreseeable future. An inflation target of 2% out of Tokyo is a hefty order, and will more than likely require a somewhat unlimited amount of manipulation. Because of this, we believe that this market will continue to grind higher, but the move that we are seeing right now is simply a market that’s taking a few minutes to catch its breath after shooting so high, so quick.

For us, a breakout above the 90 handle would be massive in its implications. We think this will eventually happen, and we do expect to see a 95 print sometime in the spring. With that being the case, we are looking for supportive price action to buy at lower levels. We have a hard time believing that the market will get below 86.50 though, as there is so much noise between here and there.

Written by FX Empire