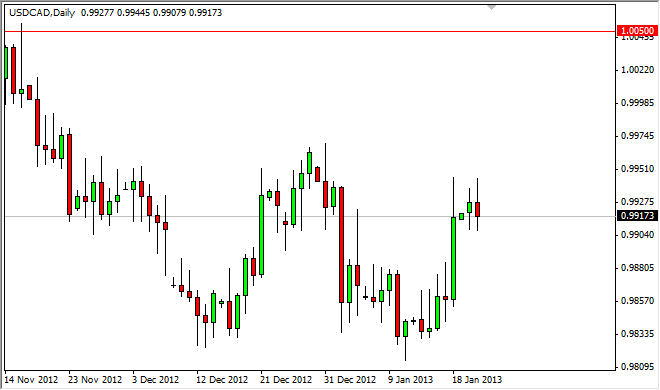

The USD/CAD pair initially rallied during the session on Tuesday, but found the 0.9950 level far too resistant yet again. Because of this, we formed a candle that looks somewhat like a shooting star it certainly looks to mean the same thing. In other words, this market may have overextended itself the other day as we broke above the 0.99 handle.

Looking at the chart, we have been in an obvious consolidation area for quite some time, and as a result we believe that sellers are stepping in to play the range. What’s interesting about this chart is the fact that the light sweet crude markets have been rallying while the Canadian dollar has been softening over the last couple of sessions. A return to bearishness in this marketplace would of course be a remedy for that, and could send the CAD higher against many other currencies around the world.

Expanding the chart out, we see the 1.0050 level as far too resistant for the market the breakout of at this point. If for some reason that happened, this would be very bullish for this pair, and we would be aggressively long at that point. However, it looks much more likely that we could break down and through the 0.98 support level, and as a result we are much more comfortable selling this market. Besides, the overall trend is certainly to the downside, and that always makes the trade much easier to take.

If we managed to break the bottom of the candle for Tuesday, which of course is essentially the 0.99 handle, we are comfortable selling this pair and aiming for the 0.9830 level. This trade would be simply playing the range, nothing more, and nothing less. This is the type trade that you continue to do over and over until it doesn’t work. Sooner or later, we will break out of the consolidation area, but typically we continue the overall trend when it happens, and as a result we will always be more comfortable selling that buying as the last few years have generally favored the Loonie.

Written by FX Empire