Gold prices continue to extend higher as the EU sets to announce a historic €750 billion coronavirus stimulus. The US Congress is also debating for a new aid package to counter the economic effects of the pandemic. With all the unprecedented fiscal and monetary stimulus, market once again seems to expect inflation to make a return. In addition to strong demand in Gold to hedge against inflation, demands on Treasury inflation protected securities (TIPS) soar, as well as platinum, silver and copper.

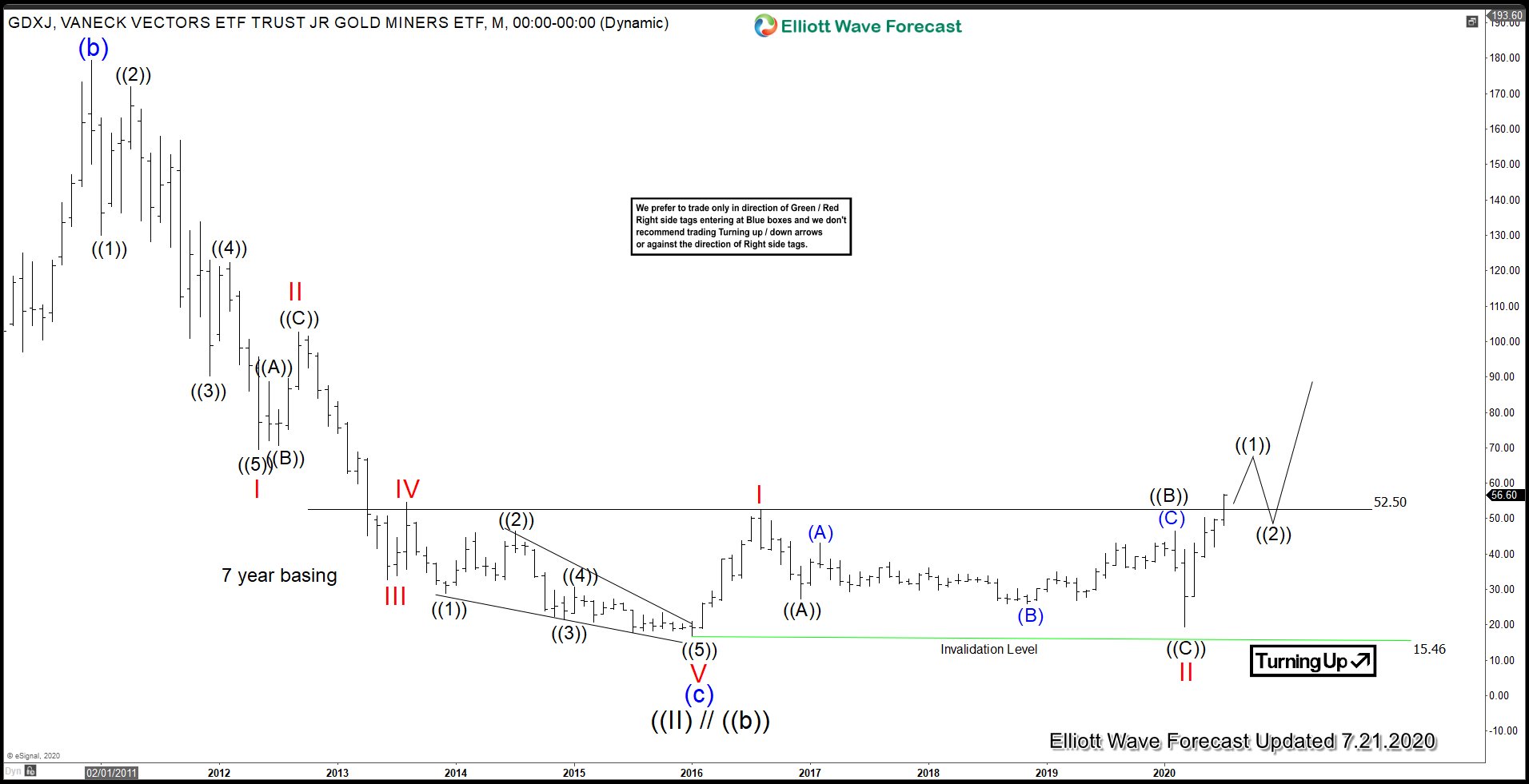

GDXJ Monthly Elliott Wave Chart

Gold Miners Junior (GDXJ) has finally broken above a 7 year base this month as the above chart shows. This is a very bullish development and calling for further upside in the next years to come. Pullback can now see support at the resistance turned support at 52.5 for further upside in coming months / years. Despite the rally since March low, it’s still at the early stage and pullback should continue to see support in 3, 7, 11 swing

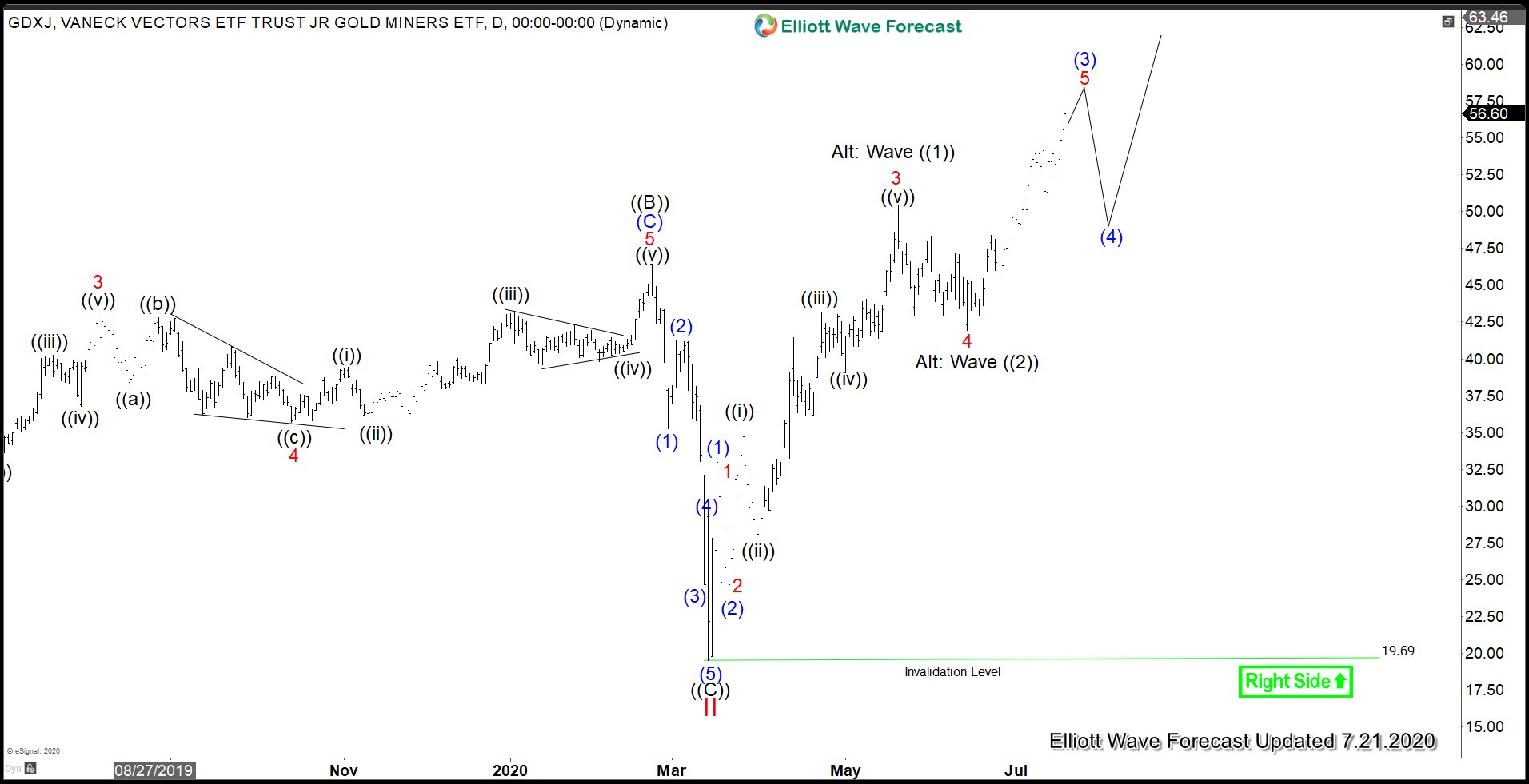

GDXJ Daily Elliott Wave Chart

Daily Elliott Wave chart of GDXJ above suggests the rally from March (Covid-19) low remains in progress as 5 waves impulse structure. The current view suggests a few more highs is still expected before ending wave ((1)) of III. Alternatively, wave ((1)) and ((2)) have been completed with wave ((2)) connector ended on June 15 low at $41.93. In this more bullish alternate scenario, the GDXJ has already started a powerful wave ((3)).