WTI’s price action has taken a bearish turn, breaking a key support level. This analysis examines the technical situation and explores potential scenarios for the oil market.

WTI Falls Below Channel:

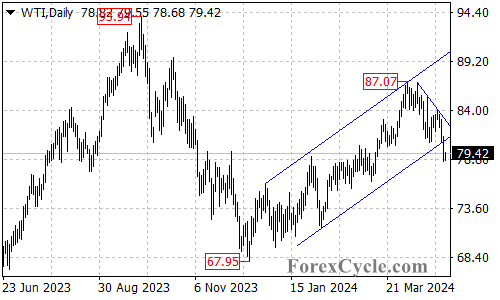

- Upside Move at Risk: A significant technical development is the break below the bottom of the rising price channel on the daily chart. This price channel had been a strong support zone throughout the recent uptrend that began at 67.95. The break suggests a potential completion of the upside move that reached a high of 87.07.

Downturn or Correction? Support and Resistance in Focus

- Further Decline Likely: In the coming days, a further decline is likely with the next target zone potentially around the 76.00 area.

- Breakdown Risk: A break below 76.00 could trigger a steeper decline towards the 70.50 area.

- Initial Resistance: If the price attempts to recover, the initial resistance level to watch is at 80.00. A break above this level could indicate a short-term correction within the broader downtrend.

- Falling Trend Line Resistance: A more significant hurdle for a sustained recovery would be the falling trend line on the daily chart. Only a decisive break above this resistance level could signal a potential resumption of the uptrend and a possible rise towards 90.00.

Overall Sentiment:

The technical outlook for WTI has turned bearish in the short term. The break below the channel support suggests a potential return to the downtrend. However, close monitoring of the price action around the resistance levels is crucial to see if the decline accelerates or if a corrective bounce emerges.