USDCAD faces a critical juncture, with a key resistance level potentially dictating the future direction of the currency pair. This analysis examines the technical situation and explores potential scenarios.

USDCAD Encounters Resistance:

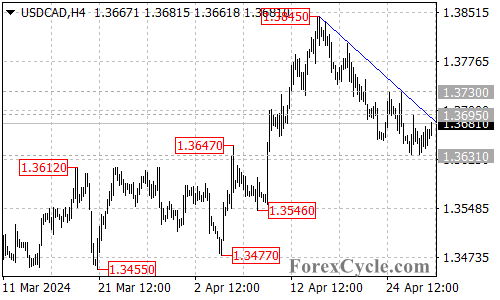

- Falling Trend Line in Focus: A major technical hurdle for USDCAD is the falling trend line on the 4-hour chart. This trend line has served as resistance throughout the recent downtrend that began at 1.3845.

Downtrend Consolidation or Reversal?

- Breakout or Breakdown Crucial: The price action around the trend line will be crucial. If the trend line resistance holds, the recent rise from 1.3631 could be interpreted as a consolidation phase within the broader downtrend.

- Downturn Risk: In a consolidation scenario, another decline towards the 1.3550 area after the rally could be possible.

Uptrend Potential on Breakout:

- Breakout Watch: A decisive break above the falling trend line resistance would be a significant development. This breakout could signal a potential reversal of the downtrend.

- Upside Targets: If a breakout occurs, the next potential resistance level to watch would be 1.3695. A further rise above this level could trigger a move to test the key resistance at 1.3730.

- Trend Reversal Confirmation: Successfully surpassing 1.3730 would be a strong bullish signal, potentially confirming that the downside move from 1.3845 has ended. In this scenario, another rise towards 1.3850 could be seen.

Overall Sentiment:

The technical outlook for USDCAD is uncertain in the short term. The price action around the falling trend line will be essential to determine the direction. A hold at the resistance suggests a continuation of the downtrend, while a breakout indicates a potential uptrend reversal. Close monitoring of these levels is crucial.