USDJPY has encountered a hurdle after a strong surge, dipping from its recent high. This analysis examines the technical situation and explores potential scenarios for the currency pair.

Bulls Meet Resistance:

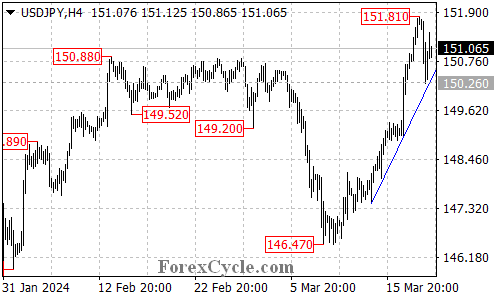

- Pullback from Highs: USDJPY has seen a correction, pulling back from a high of 151.81 to reach as low as 150.26.

Support in Sight:

- Trend Line in Focus: The currency pair is now approaching a critical support level – the rising trend line visible on the 4-hour chart.

Will the Uptrend Hold?

- Consolidation or Reversal: The price action around the trend line support will be crucial in determining the future direction of USDJPY.

- Bullish Case: If the trend line support holds, the recent pullback could be considered a consolidation phase within the broader uptrend that began at 146.47. In this scenario, further gains could be expected after the consolidation, with the next target zone potentially around the 170.00 area.

- Bearish Case: Conversely, a breakdown below the trend line support would suggest a weakening of the uptrend and could even signal a potential trend reversal.

Key Support Level:

- 150.26 Crucial Support: A close eye should be kept on the price action around 150.26. This level represents the key support.

- Downside Implications: A breakdown below 150.26 could indicate a completion of the uptrend from 146.47. If this occurs, the next target zone to watch could be around the 149.00 area.

Overall Sentiment:

The technical outlook for USDJPY is currently uncertain. The pullback and the proximity to the trend line support create a pivotal moment. A hold at the trend line would favor the bulls, while a break below could signal a bearish shift. Close monitoring of price action around these key levels will be essential in determining the future direction of USDJPY.