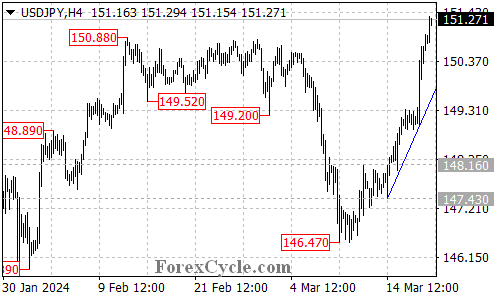

USDJPY has displayed a significant bullish breakout, surpassing a key resistance level. This analysis examines the technical situation and explores potential scenarios for the currency pair.

Bulls Charge Higher:

- Resistance Overcome: USDJPY decisively surged above the resistance level at 150.88. This technical indicator suggests a potential continuation of the uptrend that began at 146.47.

- Fresh High Established: The upside move extended further, reaching a new high of 151.33. This price action reinforces the bullish momentum.

Upside Targets in Sight:

- Further Rally Likely: As long as the price remains above the rising trend line on the 4-hour chart, a further rise is still possible in the coming days. The next potential target zone could be around 160.00.

Support Levels to Consider:

- 150.35 Initial Support: While the immediate outlook appears bullish, it’s important to acknowledge potential support areas. The initial level to watch is the newly established support at 150.35.

- Rising Trend Line as Crucial Support: A breakdown below 150.35 might indicate a period of consolidation for the uptrend. However, as long as the price remains above the rising trend line, the overall bullish trend is likely to hold.

- Trend Line Break a Major Signal: Only a break below the rising trend line support would be a significant bearish sign. This scenario could suggest a completion of the uptrend from 146.47.

Overall Sentiment:

The technical outlook for USDJPY is bullish in the short term. The breakout above 150.88 and the rise to 151.33 suggest a strong uptrend. However, close attention should be paid to the support levels, particularly the rising trend line. A break below this level could signal a pause or a reversal of the uptrend. Monitoring price action around these key areas will be crucial in determining the future direction of USDJPY.