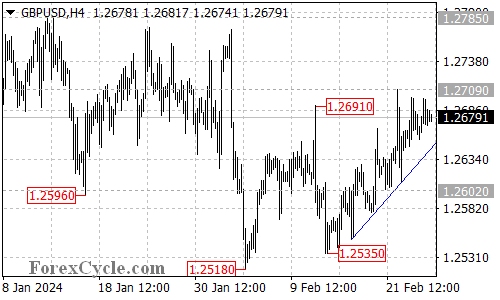

GBPUSD remains in an uptrend that began at 1.2535, continuing to trade above the rising trend line on the 4-hour chart. This technical analysis explores the potential scenarios based on the current price action and key support and resistance levels.

Uptrend in Focus: Can the Bulls Maintain Momentum?

- Rising Trend Line Support: As long as the price holds above the rising trend line, the uptrend remains intact. This suggests the bulls are still in control, and further upside can be expected.

- 1.2709 Resistance Test: A crucial test awaits GBPUSD at the 1.2709 resistance level. A decisive break above this level could open the door for a rise towards the 1.2750 area, further solidifying the uptrend.

Potential Downturn Signals: Support Levels to Watch

- Breakdown Below Trend Line: If the price falls below the rising trend line support, it would signal a potential loss of momentum and a possible trend reversal.

- 1.2602 and 1.2518: Support Awaits: In the event of a breakdown, the next support levels to watch are 1.2602 and 1.2518. A breach of these levels would indicate increasing bearish pressure and could lead to a deeper decline.

Overall Sentiment:

The technical outlook for GBPUSD is currently bullish as long as the price holds above the rising trend line. However, a breakdown below this support and subsequent breaches of lower support levels could signal a trend reversal and a potential decline. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.