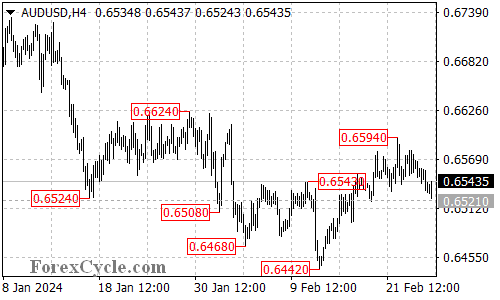

AUDUSD has been caught in a sideways movement between 0.6521 and 0.6594, leaving the near-term direction unclear. This analysis explores the potential implications of this price action, considering both bullish and bearish scenarios.

Uptrend on Hold? Consolidation or Correction?

- 0.6521 Support: The Bullish Anchor: As long as the price remains above this crucial support level, the uptrend initiated at 0.6442 remains valid. This suggests the current sideways movement could be a healthy consolidation phase within the ongoing uptrend.

- Breakout Potential: If the bulls manage to regain momentum and push the price above the 0.6594 resistance, it could signal a breakout from the range and trigger another rise towards the 0.6624 resistance, potentially solidifying the uptrend.

Downturn Signals: Watching for Support Cracks

- 0.6521 Breach: Reversal Indicator: A breakdown below the 0.6521 support level would be a significant development, potentially indicating a completion of the uptrend from 0.6442. This could lead to another fall towards the previous low of 0.6442, marking a potential trend reversal.

Overall Sentiment:

The current technical picture for AUDUSD presents mixed signals. The sideways movement creates uncertainty, leaving the near-term direction unclear. While holding above 0.6521 and breaking above 0.6594 suggest potential bullish continuation, a breakdown below support could signal a trend reversal and further decline. Monitoring the price action around the mentioned support and resistance levels will be crucial in determining the pair’s next move.