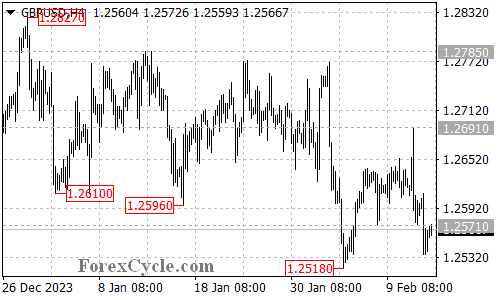

GBPUSD has dropped below the key support level of 1.2571, raising concerns about a potential continuation of the downtrend from 1.2827. Let’s analyze the technicals to understand what this means for the pair’s near-term direction.

Downtrend Resumption or Consolidation?

- Broken Support: The breach of 1.2571 suggests that sellers are in control, potentially indicating a renewed downtrend.

- Potential Downside Target: In the coming days, the pair could fall further towards the next support level at 1.2518.

- Further Decline Possible: If the selling pressure persists and breaks below 1.2518, the next potential target could be the 1.2400 area.

Resistance Levels to Watch for a Bounce

- Immediate Hurdle: If the sellers take a breather and buyers step in, the initial resistance to overcome is at 1.2610.

- Retest Chance: Reclaiming this level could trigger a retest of the previous resistance at 1.2691.

- Upside Potential: Surpassing 1.2691 could indicate a more significant bullish move, potentially aiming for the 1.2785 resistance level.

Overall Sentiment

The breakdown below 1.2571 suggests a bearish tilt for GBPUSD in the near term. The potential downside targets and overall technical picture favor a downtrend continuation. However, a break above 1.2610 could signal a temporary pause or even a trend reversal. Monitoring the price action around the mentioned support and resistance levels will be crucial to confirm the pair’s next move.