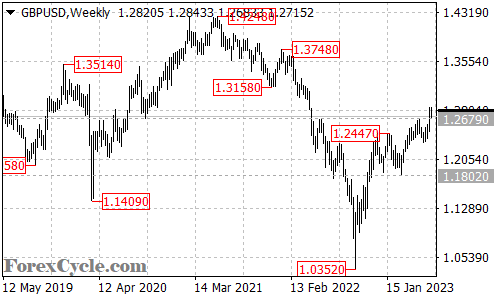

The GBPUSD currency pair has been displaying a long-term uptrend, with its origins traced back to 1.0352. Despite occasional periods of consolidation and pullbacks, the overall trajectory remains skewed to the upside. Traders are closely monitoring key support and resistance levels to gauge the potential for further upward movement.

At present, as long as the 1.2300 support level remains intact, the prevailing expectation is for the uptrend to persist. This support level acts as a critical threshold, and as long as it holds, market participants anticipate a continuation of the upward move. Traders are positioning themselves to take advantage of potential buying opportunities, aiming for the next target around the 1.3200 area.

On the downside, a breakdown below the 1.2300 support level would require careful consideration. It could signal a shift in market sentiment and raise concerns about the sustainability of the long-term uptrend. In such a scenario, the price may retreat towards the 1.1802 support level. Market participants should closely monitor the price action around this level, as a breach could potentially indicate the completion of the long-term uptrend.

In summary, GBPUSD remains in a long-term uptrend from 1.0352. The ongoing expectation is for the uptrend to continue as long as the 1.2300 support level holds. The next target for the pair is around the 1.3200 area. However, a breakdown below 1.2300 would warrant caution and could potentially lead to a retracement towards the 1.1802 support level. Traders should stay vigilant, monitor key levels, and stay informed about relevant market developments to make informed trading decisions.