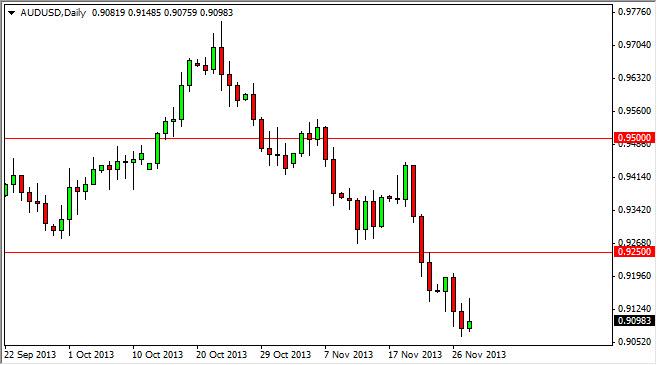

The AUD/USD pair tried to rally during the session on Thursday, but as you can see gave up most of the gains. The resulting candle of course is a shooting star, and that is obviously a very negative sign. The negative sign points to more selling of the Australian dollar, and we still believe that the market is heading to the 0.90 handle before it’s all said and done. Because of this, we believe that selling is the only thing you can do, and a break of the bottom of the shooting star might be a decent enough signal for short-term trader, but we would also expect a bounce from the 0.90 handle as it is a major round number.

Breaking the top of the shooting star is a very bullish sign, but we don’t expect it to lead to a large rally. That’s because the 0.9250 level should offer plenty of resistance. In fact, we would be very interested in selling a resistive candle in that general vicinity as it should attract a lot of selling pressure. After all, there is still a lot of questions around the Federal Reserve and whether or not they can taper, but it appears that the market is essentially thinking it will. On top of that, the gold markets look very soft at the moment, and that of course always ways upon the Australian dollar when it starts to sell off.

If the Federal Reserve does in fact taper off of quantitative easing, this should absolutely crush this pair. However, we are aware the fact that this fall that we have seen over the last couple of weeks has been fairly dramatic, so it would make sense that we get a bounce from the 0.90 handle, and a pullback to the 0.9250 level wouldn’t exactly be a real stretch of imagination.

With that being said, we are very bearish of this pair, and will not buy into we clear the 0.93 handle on a daily close. Above there, things change completely and we think the Australian dollar could pick up some real strength.

Written by FX Empire