In this technical blog, we are going to take a look at the past performance of CADJPY Daily Elliott wave Charts that we presented to our members. In which, the decline from 7.10.2024 high took place in a double three corrective sequence and showed a lower sequence calling for more downside to happen. Therefore, our members knew that selling the bounces in the direction of the right side tag remained the preferred path. We will explain the Elliott wave structure & selling opportunity our members took below:

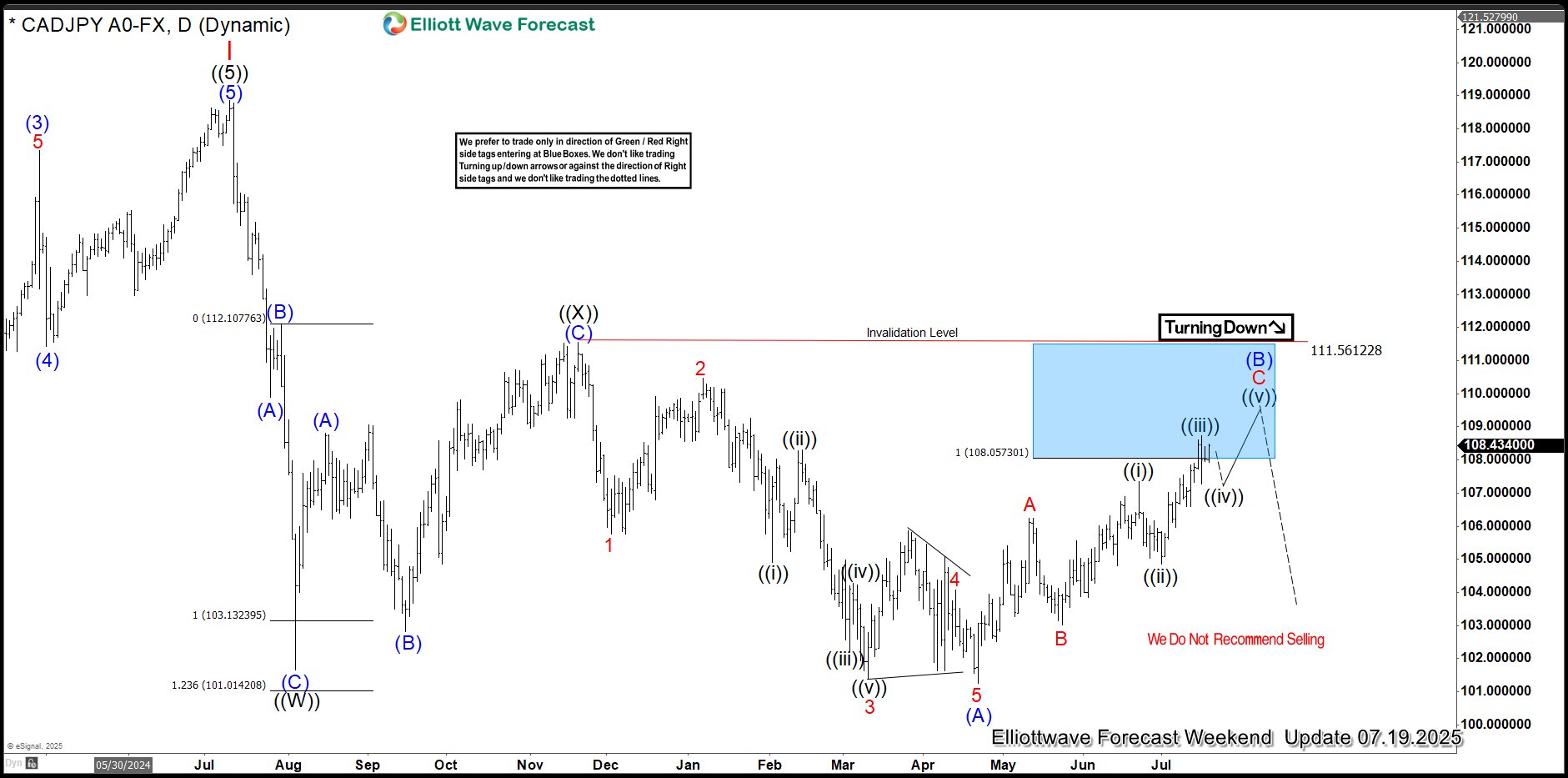

CADJPY Daily Elliott Wave Chart From 7.19.2025

CADJPY Daily Elliott Wave Chart from 7.19.2025 Weekend update. In which the pair is showing 5 swings lower low sequence supporting 6th bounce to fail for another leg lower to complete 7 swings corrective sequence from the peak. Whereas the decline to 101.26 low ended wave (A) of ((Y)). Up from there, the pair made a bounce towards the blue box area within wave (B). The internals of that bounce unfolded as zigzag structure where wave A ended at 106.25 high. Wave B pullback ended at 103.01 low. And wave C managed to reach the blue box area. From there, sellers were expected to appear looking for further downside or a minimum 3-wave reaction lower.

CADJPY Latest Daily Elliott Wave Chart From 9.06.2025

This is the latest Daily view from the 9.06.2025 Weekend update. In which the pair is showing a reaction lower taking place from the blue box area. Allowing shorts to get into a risk-free position shortly after taking the position. However, a break below 101.26 low is needed to confirm the next extension lower & avoid double correction lower.

Source: https://elliottwave-forecast.com/bluebox-wins/blue-box-payoff-cadjpy-drops-predicted/