Pan American Silver Corp. is one of the world’s leading precious metals mining companies, headquartered in Vancouver, Canada. With a diversified portfolio of silver and gold mines across Latin America and Canada—including key operations in Mexico, Peru, Bolivia, Argentina, and Chile—PAAS offers investors substantial exposure to silver through long-life reserves and expanding production.

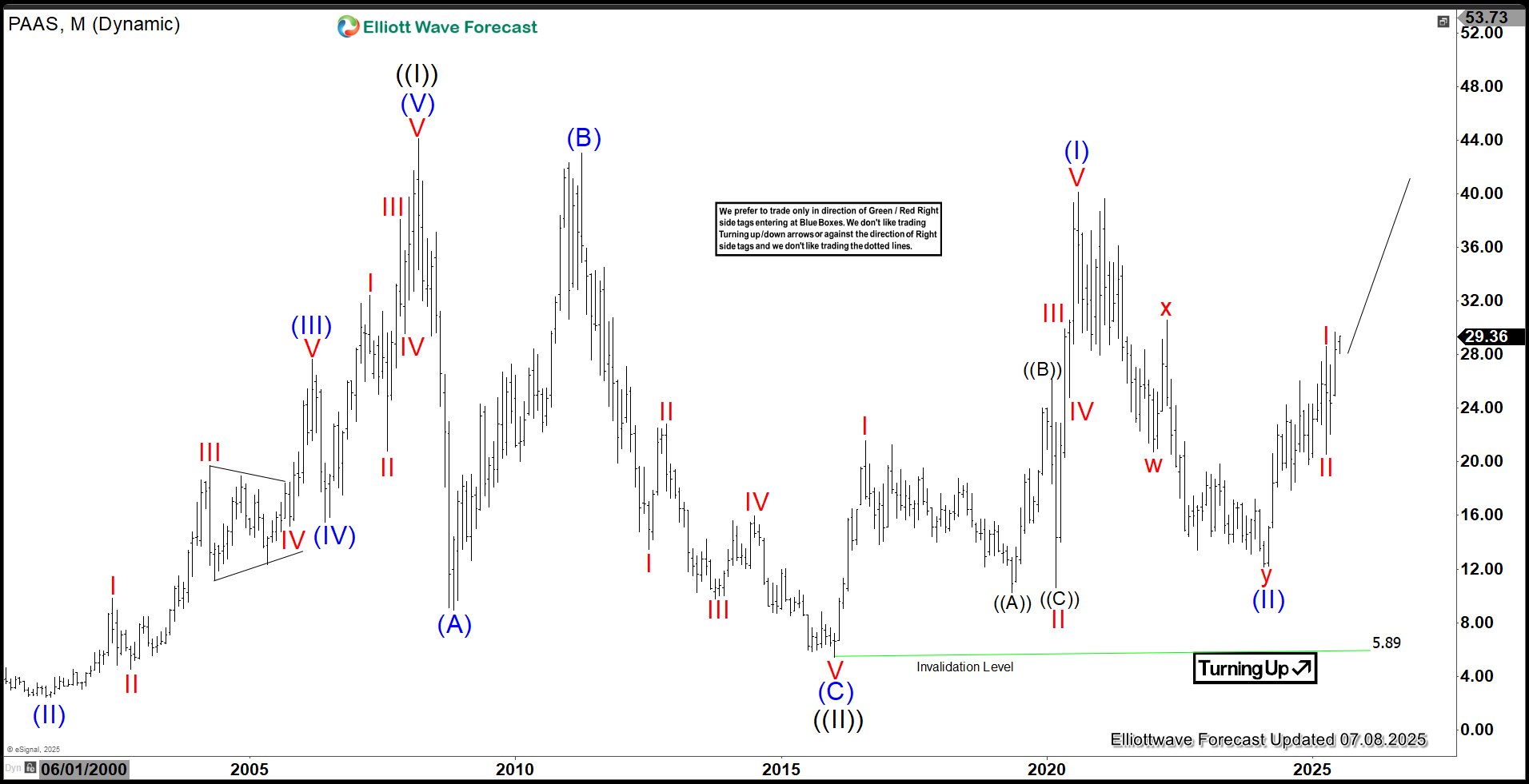

PAAS Monthly Elliott Wave Chart

The monthly Elliott Wave outlook for Pan American Silver (PAAS) reveals a sustained bullish progression. The bullish move began after the wave ((II)) correction concluded at $5.89 in January 2016. That low served as the springboard for the unfolding wave ((III)), signaling a major trend reversal. From that turning point, the initial rally in wave (I) drove prices to a high of $40.11. Then a deeper retracement in wave (II) followed which bottomed at $12.16. The advance has since resumed in wave (III), suggesting renewed momentum is building. Within this larger wave structure, wave I peaked at $27.47, followed by a wave II pullback that found support at $20.55. As long as PAAS holds above the $5.89 low, the broader bullish outlook remains intact, favoring continued upside as wave (III) further develops.

PAAS Daily Elliott Wave Chart

Pan American Silver (PAAS) is tracing a clear Elliott Wave roadmap on the daily chart. This reflects a sustained bullish trajectory that originated from the $12.19 lo – a pivotal level marking the completion of wave (II). From there, the stock embarked on wave I, forming a leading diagonal structure. Wave ((1)) topped at $24.27, then softened to $17.86 in wave ((2)). The rally continued with wave ((3)) extending to $26.05. Wave ((4)) retraced to $19.80, and wave ((5)) finalized the diagonal at $27.47, thereby completing wave I.

Wave II followed with a measured pullback to $20.55. This sets the stage for the next phase higher—wave III, now unfolding as a classic impulsive pattern. Early signs are promising: wave ((1)) of III terminated at $28.60, and wave ((2)) concluded at $22.08. With the foundational low of $12.19 still intact, the broader bullish structure remains firmly supported. The structure favors further advances as wave III gains momentum.

Source: https://elliottwave-forecast.com/stock-market/pan-american-silver-paas-ready-push-higher/