Polygon (formerly Matic Network, MATICUSD) is a Layer 2 scaling solution backed by Binance and Coinbase. The project seeks to stimulate mass adoption of cryptocurrencies by resolving the problems of scalability on many blockchains. Polygon combines the Plasma Framework and the proof-of-stake blockchain architecture.

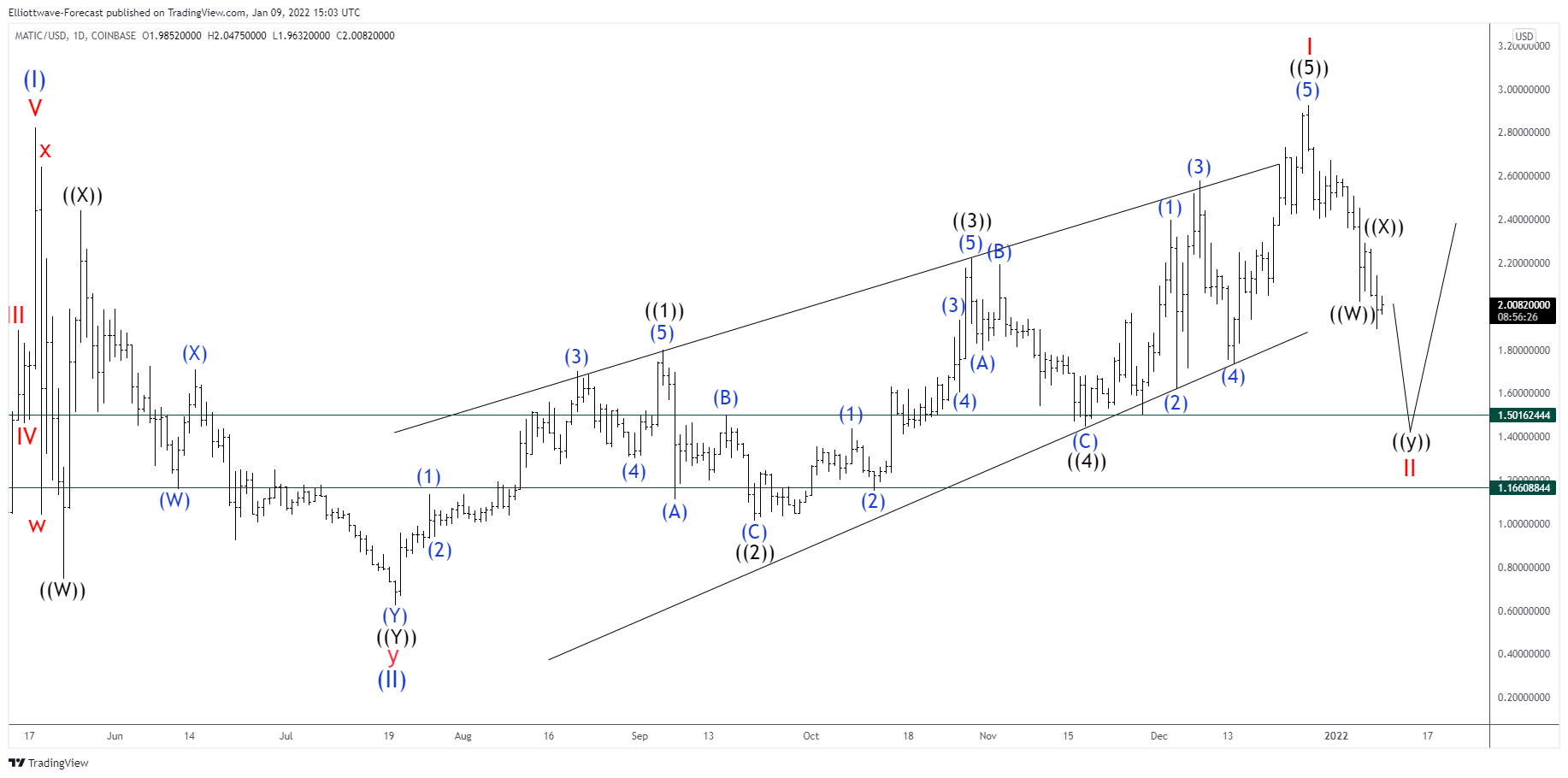

MATICUSD Daily Chart

MATICUSD started a rally from July 20th 2021 low. From there we can see 5 waves up forming a Leading Diagonal Structure ending on December 27th. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory). Wave ((1)) ended an impulse structure at 1.7991. Then MATICUSD corrected in 3 swings making a zig zag structure, ending wave ((2)) at 1.0148. Another rally resumed from the low completing wave ((3)) at 2.2200 and pullback again making a flat correction ended wave ((4)) at 1.4446. Then last push higher made an ending diagonal structure and completed wave ((5)) and wave I of the leading diagonal at 2.9249.

At the end of December, the cryptocurrency dropped strongly losing more than 15%. MATICUSD continued falling, in 3 swings, to 2.0210 and we labeled this movement as wave ((W)). Then we have seen a bounce ending at 2.2919 and turn lower again. We labeled the bounce as wave ((X)) and from here we are calling 3 swings more down to draw a double correction structure to end wave ((Y)) and wave II. To conclude the whole correction as wave II we are suggesting a 1.5016 – 1.1660 area where MATICUSD should continue with the rally.

Source: https://elliottwave-forecast.com/elliottwave/maticusd-see-downside-short-term/