In this blog, I want to share some short-term Elliott Wave charts of Facebook which we presented to our members in the past.

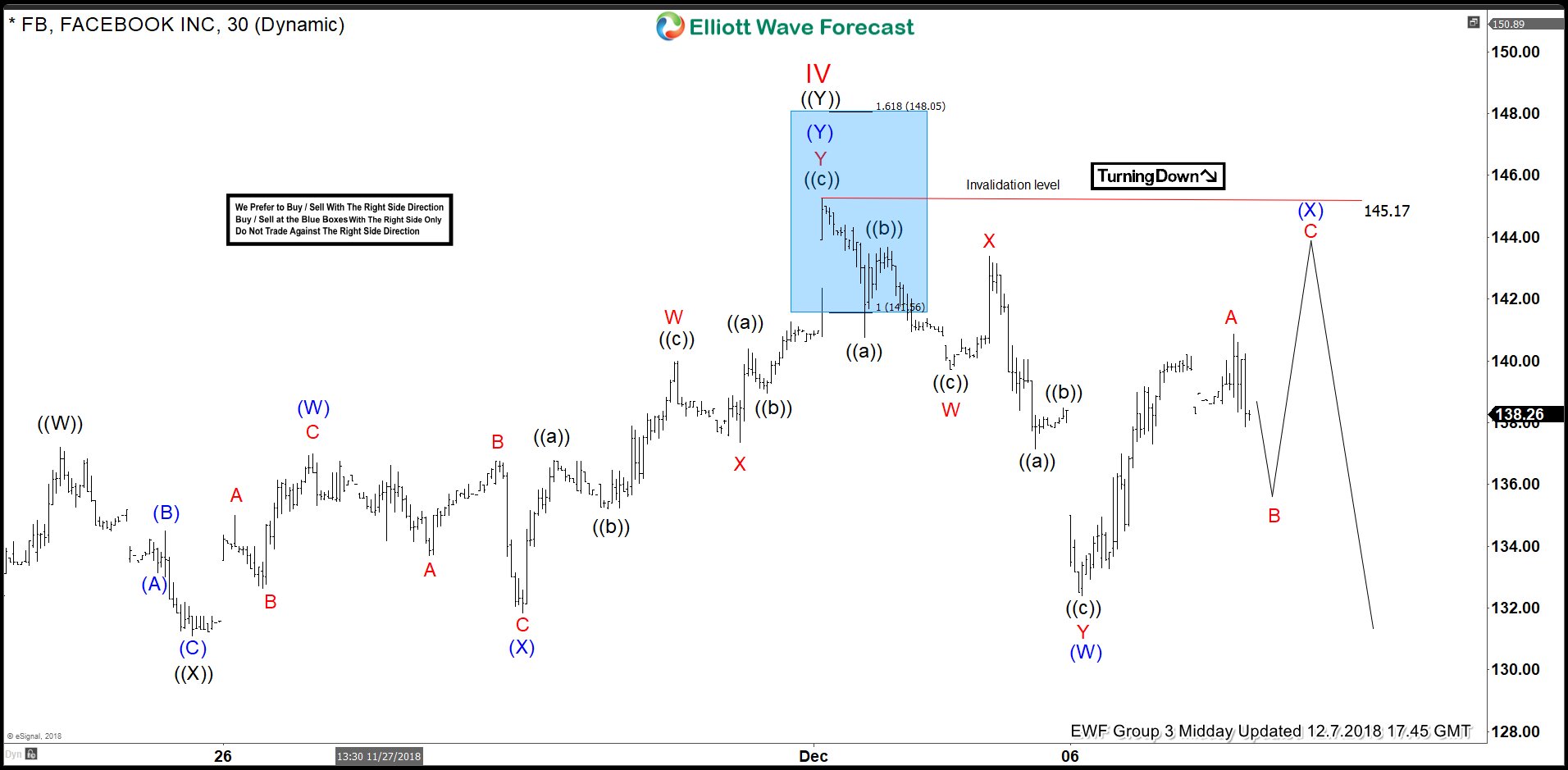

In this blog, I want to share some short-term Elliott Wave charts of Facebook which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 12/02/18. Showing that Facebook ended the cycle from 09/27/18 peak in red wave III at 11/20/18 low (128.45).

As Facebook ended the cycle from 09/27/18 peak, we expected a bounce to occur in red wave IV. Above from 11/20/18 low (128.45), the bounce unfolded in an Elliott Wave double correction structure. We advised members that Facebook ideally should continue lower. Therefore, we expected sellers to appear in the sequences of 3, 7 or 11 swings. At the 100 – 1.236 Fibonacci extension of black ((W))-((X)) which came at around 141.41-147.77 area and that was the first area for sellers to appear.

Facebook 12.02.2018 1 Hour Chart Elliott Wave Analysis

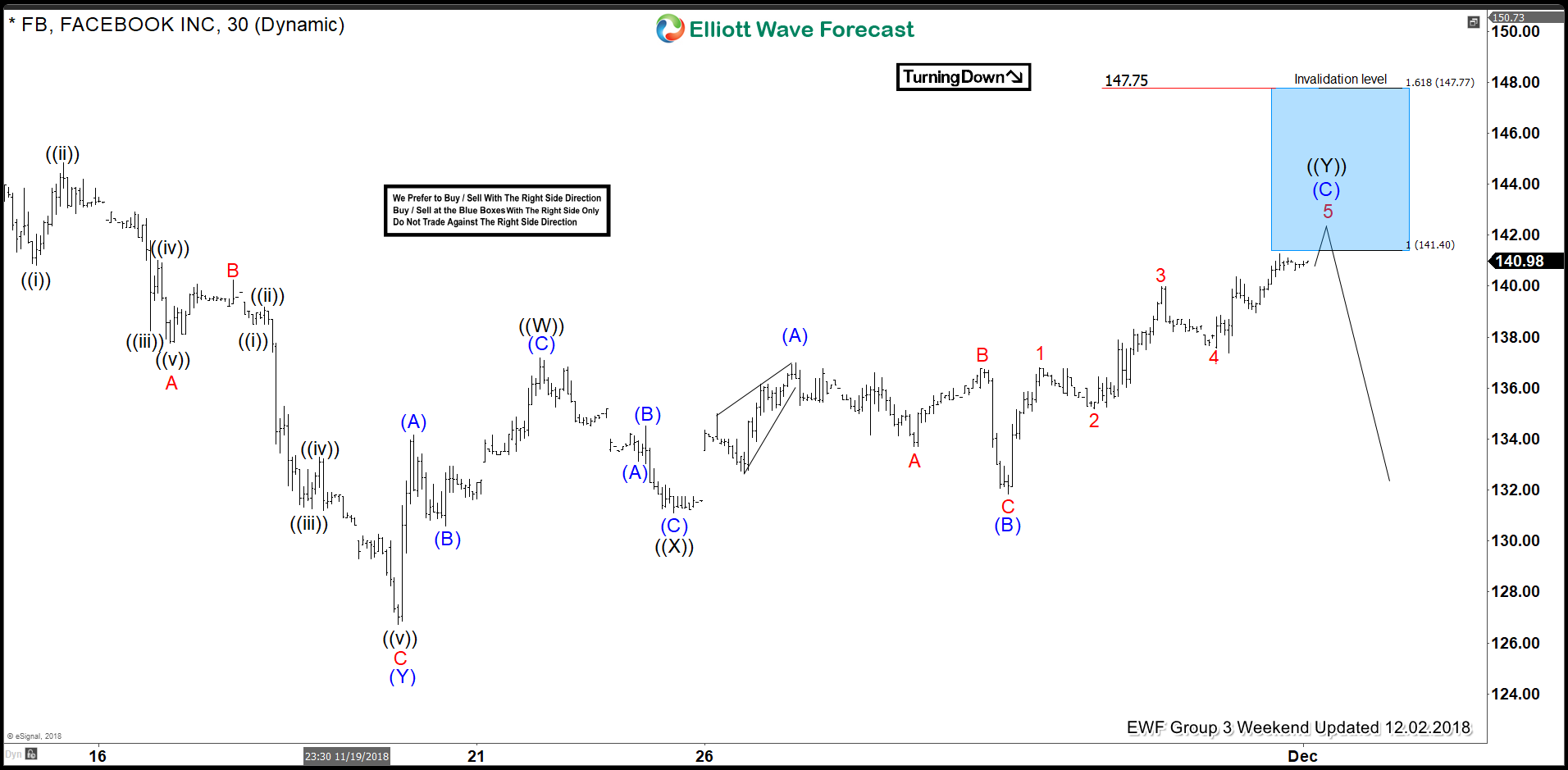

In the last Elliott Wave chart. You can see that the stock reached the blue box area (141.41-147.77) and reacted nicely lower. If traded our blue box area shown in the chart above. Then, any trades from that area were risk-free, which means the stop-loss should be moved to break even, targeting lower levels. Do please keep in mind that the 1-hour chart which I presented may have changed already. And as long as Facebook doesn’t break 11/20/18 low (128.45). A double correction in red wave IV higher still can’t be ruled out. This blog should just illustrate how accurate our blue boxes are, and how our members trade our 3-7 or 11 swings strategy.

Facebook 12.07.2018 1 Hour Chart Elliott Wave Analysis