Bloom Energy Corporation., (BE) designs, manufactures, sells & install solid-oxide fuel cell systems for on-site power generation in the United States & globally. It offers Bloom Energy Server, a power generation platform to convert different fuels like Natural gas, Biogas, Hydrogen or blended fuel into electricity through electrochemical process. It comes under Industrials sector & trades at “BE” ticker at NYSE.

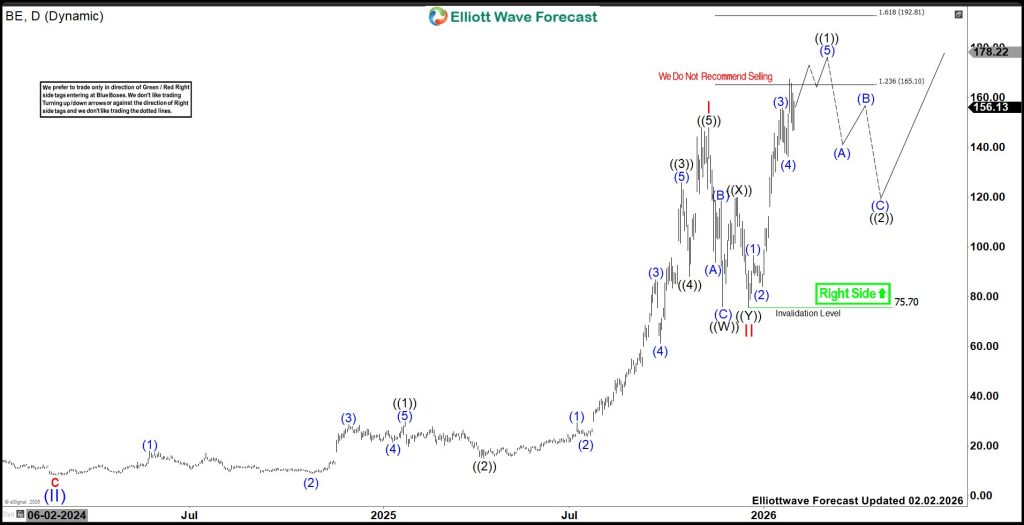

The BE favors impulse rally in ((1)) of III as broke above November-2025 high. It favors rally in (5) towards $165.10 – $192.81 area to end ((1)) started from 12.17.2025 low, while above 1.27.2026 low. The chasing at this level can be risky, so better to wait for pullback in ((2)) as next opportunity.

BE – Elliott Wave Latest Daily View:

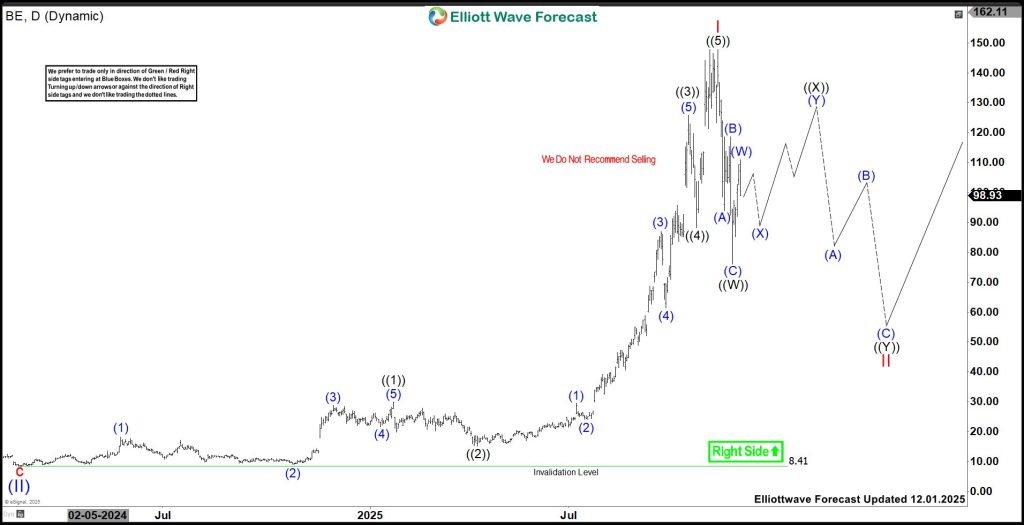

In weekly, it made all time low of $2.44 in October-2019. It placed (I) at $44.95 high of February-2021 & (II) at $8.41 low of February-2024. Above there, it ended I of (III) at $147.86 high on 11.10.2025 high & II at $75.70 low on 12.17.2025. It placed ((1)) of I at $29.82 high, ((2)) at $15.15 low, ((3)) at $125.75 high, ((4)) at $88.23 low & ((5)) at $147.86 high. Within extended ((3)), it ended (1) at $29.44 high, (2) at $24.04 low, (3) at $86.89 high, (4) at $61.37 low & (5) at $125.75 high. Below I high, it placed ((W)) at $76 low, ((X)) at $119.90 high & ((Y)) at $75.70 low as truncated move to end II correction.

BE – Elliott Wave Daily View From 12.01.2025:

Above II low, it favors (5) of ((1)) of III, while dips remain above 1.27.2026 low. It ended (1) at $96.49 high, (2) at $84.14 low, (3) at $155.87 high, (4) at $136.25 low & favors upside in (5). It expects (5) to extend into $165.10 – $192.81 area to end ((1)) before correcting in ((2)). The buyers should not chase longs at current level. Rather than, we like to buy the next pullback in ((2)) in 3, 7 or 11 swings against December-2025 low.

Source: https://elliottwave-forecast.com/stock-market/bloom-be-should-buy-breakout-wait-pullback/