Post Wave II Base Near ₹194.80 Signals Fresh Bullish Cycle With Strong Upside Potential

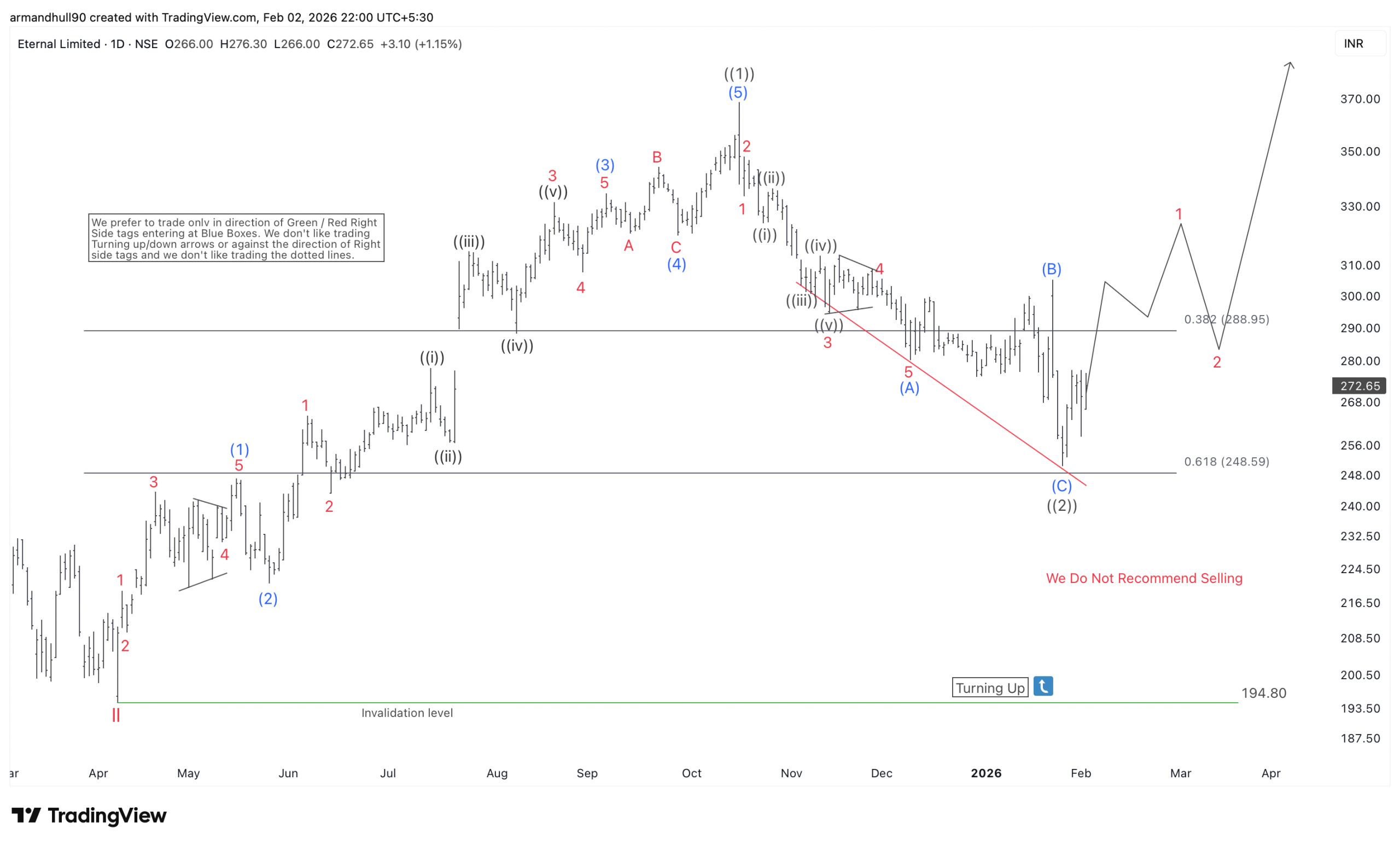

Eternal Ltd has completed a meaningful corrective phase and is now showing early signs of a fresh bullish cycle. After ending a larger degree wave II correction near 194.80, price action has started to turn higher. This level acted as a strong base, and buyers stepped in with strength, suggesting that the larger uptrend remains intact. From an Elliott Wave perspective, the stock now appears to be progressing through the early stages of wave III, which is usually the most powerful phase in any bullish cycle.

The initial move higher from the 194.80 low unfolded in a clean five-wave impulsive structure, labeled as wave ((1)). This kind of price action reflects strong demand and often marks the start of a new trend. After completing wave ((1)), the stock pulled back in a three-wave ABC pattern, forming wave ((2)). This correction retraced close to 61.8% of wave ((1)), which is a common Fibonacci level for wave two pullbacks. The reaction near this zone suggests that selling pressure is weakening and that the correction is either complete around the 250 area or very close to ending.

What Comes Next for Eternal?

With wave ((2)) near completion, Eternal Ltd is well positioned to resume higher in wave ((3)). This phase is typically strong, fast, and broad-based, as more participants join the trend. As long as price remains above the invalidation level near the prior wave II low, the bullish structure stays valid. The overall pattern favors further upside rather than a deeper decline.

Looking ahead, the Elliott Wave projections point toward new potential highs in the coming months. The initial upside target for wave ((3)) comes near the 470 region, which aligns with key Fibonacci relationships from the prior impulse. Beyond that, if momentum remains strong and the broader market supports the move, price can extend further toward the 690 area before any major corrective phase takes shape. These levels reflect typical extensions seen in third waves within a larger impulsive sequence.

Summary

In summary, Eternal Ltd has respected key Elliott Wave and Fibonacci levels well. The stock completed a larger wave II correction near 194.80, delivered a clear five-wave advance in wave ((1)), and corrected in a controlled manner into wave ((2)). With the structure now pointing higher, the path of least resistance remains to the upside. As long as price holds above key support, the bullish outlook remains intact, and the stock is expected to work higher toward the 470 and potentially 690 targets over time.