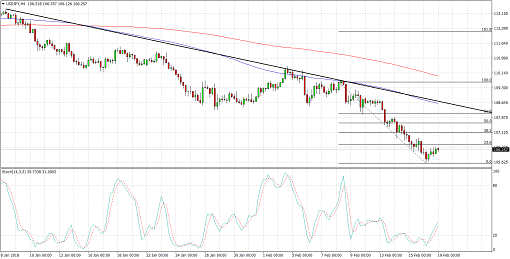

USDJPY recently broke below a major support zone, confirming that a downtrend is underway. Price appears to be finding support at current levels, though, so a pullback is also possible. Stochastic is on its way up to indicate that bears are taking a break.

Applying the Fib retracement tool on the latest swing high and low shows that the 61.8% level lines up with the trend line at 108.00 and a former support zone that could now hold as resistance. This also coincides with the 100 SMA dynamic resistance.

The 100 SMA is below the longer-term 200 SMA, confirming that the path of least resistance is to the downside or that the selloff is more likely to continue than to reverse.

Dollar weakness has been in play for the most part of the previous week, and the momentum could carry on as more issues pop up for the Trump administration. The ongoing investigation into Russia’s involvement in the US elections is raising more concerns while worries about a fiscal deficit remain.

US banks are closed in observance of President’s Day today, which means that liquidity is low and volatility could tick higher. This could also give equities reason to pause from their rallies.

Later in the week, the FOMC meeting minutes are up for release and any cautious remarks could mean another leg of losses for the US currency. There are no major reports due from Japan.

By Kate Curtis from Trader’s Way