USDJPY has encountered a technical hurdle, dipping below a key indicator. This analysis examines the technical situation and explores potential scenarios for the currency pair.

Bulls Hit a Speed Bump:

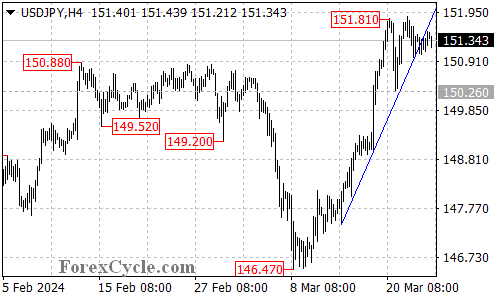

- Trend Line Broken: USDJPY has breached below the rising trend line on the 4-hour chart. This technical indicator suggests a potential weakening of the uptrend that began at 146.47.

- Consolidation Likely: The breakdown below the trend line hints at a possible lengthier consolidation phase for the uptrend.

Support Levels to Watch:

- 150.95 Initial Floor: The initial level of support to monitor is at 150.95.

- 150.26 Key Support: The most critical support level to watch is 150.26.

Upside Potential Still Exists:

- Holding Support Crucial: As long as the price holds above 150.26, the uptrend might still be intact. In this scenario, a resumption of the upside move could be expected after the consolidation phase. The next potential target zone could still be around the 170.00 area.

Downtrend Signal:

- Break Below Key Support: A breakdown below 150.26 would be a significant development. This scenario could signal a completion of the uptrend from 146.47 and a potential shift towards a downtrend.

Overall Sentiment:

The technical outlook for USDJPY has turned uncertain. The break below the trend line suggests a pause in the uptrend. However, the bulls still have a chance if price holds above key support levels.

- Holding 150.26 favors an eventual upside resumption after consolidation.

- Breaking below 150.26 suggests a potential trend reversal towards the downside.

Close monitoring of price action around these key levels will be crucial in determining the future direction of USDJPY.