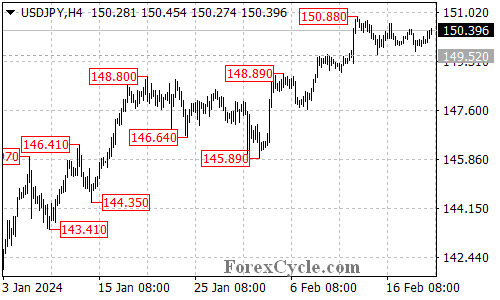

USDJPY’s recent attempt to break below 149.52 support fizzled out, leaving the pair stuck in a sideways range between 149.52 and 150.88. This indecisiveness raises questions about the future direction of the pair.

Uptrend Pause or Trend Reversal?

- 149.52 Support Holds: As long as the price stays above 149.52, two contrasting interpretations are possible:

- Consolidation: This sideways movement could be seen as a healthy pause within the ongoing uptrend that began at 145.89. If bulls regain control, a breakout above 150.88 resistance could signal further gains towards 151.90, suggesting the uptrend remains intact.

- Trend Exhaustion: Alternatively, the range could indicate the uptrend is losing momentum and a reversal might be brewing. If bears push the price below 149.52, it would suggest the uptrend from 145.89 has potentially ended.

Key Levels to Watch

- Support: 149.52 is the crucial support level. A breakdown below would signal a potential trend reversal and a decline towards the next support zone around 147.50.

- Resistance: 150.88 is the key resistance level to overcome. Surpassing this level would indicate potential bullish continuation and a retest of the previous high at 151.90.

Overall Sentiment

The technical picture presents mixed signals. While holding above 149.52 and breaking above 150.88 suggest potential bullish continuation, a breakdown below support could signal a trend reversal and further decline. Monitoring the price action around these key levels will be crucial in determining USDJPY’s next move.