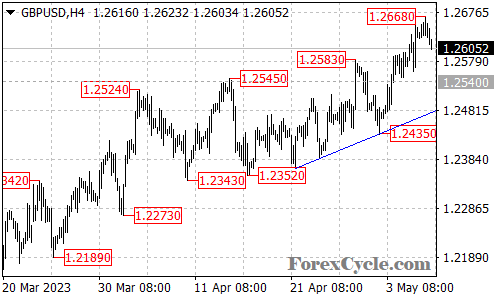

GBPUSD has been trading in a consolidating pattern recently, with the pair pulling back from its recent high of 1.2668. This suggests that a period of consolidation for the uptrend from the Mar low of 1.1802 is currently underway. Despite the pullback, the near-term support level of 1.2540 remains intact, and as long as this level holds, the uptrend is expected to continue.

Looking ahead, the next target for the pair could be at the 1.2800 level once the consolidation phase is complete. This is in line with the bullish outlook for GBPUSD, which has remained in an uptrend from its March low.

On the downside, a breakdown below the 1.2540 support level could trigger further downside movement, with the next key support level being the rising trend line on the 4-hour chart. If GBPUSD break below this trend line, the next key support level is at 1.2435. A break below this level could signal completion of the current uptrend.

Overall, GBPUSD continues to hold a bullish bias, with the pair consolidating above key support levels. While there may be some short-term volatility, the longer-term outlook remains positive, with further upside potential expected once the current consolidation phase is complete.