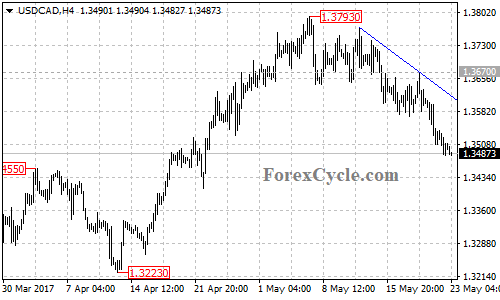

USDCAD’s bearish movement from 1.3793 extended to as low as 1.3483. Further decline is still possible after consolidation and next target would be at 1.3400 area. Resistance is at the falling trend line on 4-hour chart, only a clear break above the trend line resistance could signal completion of the downtrend.