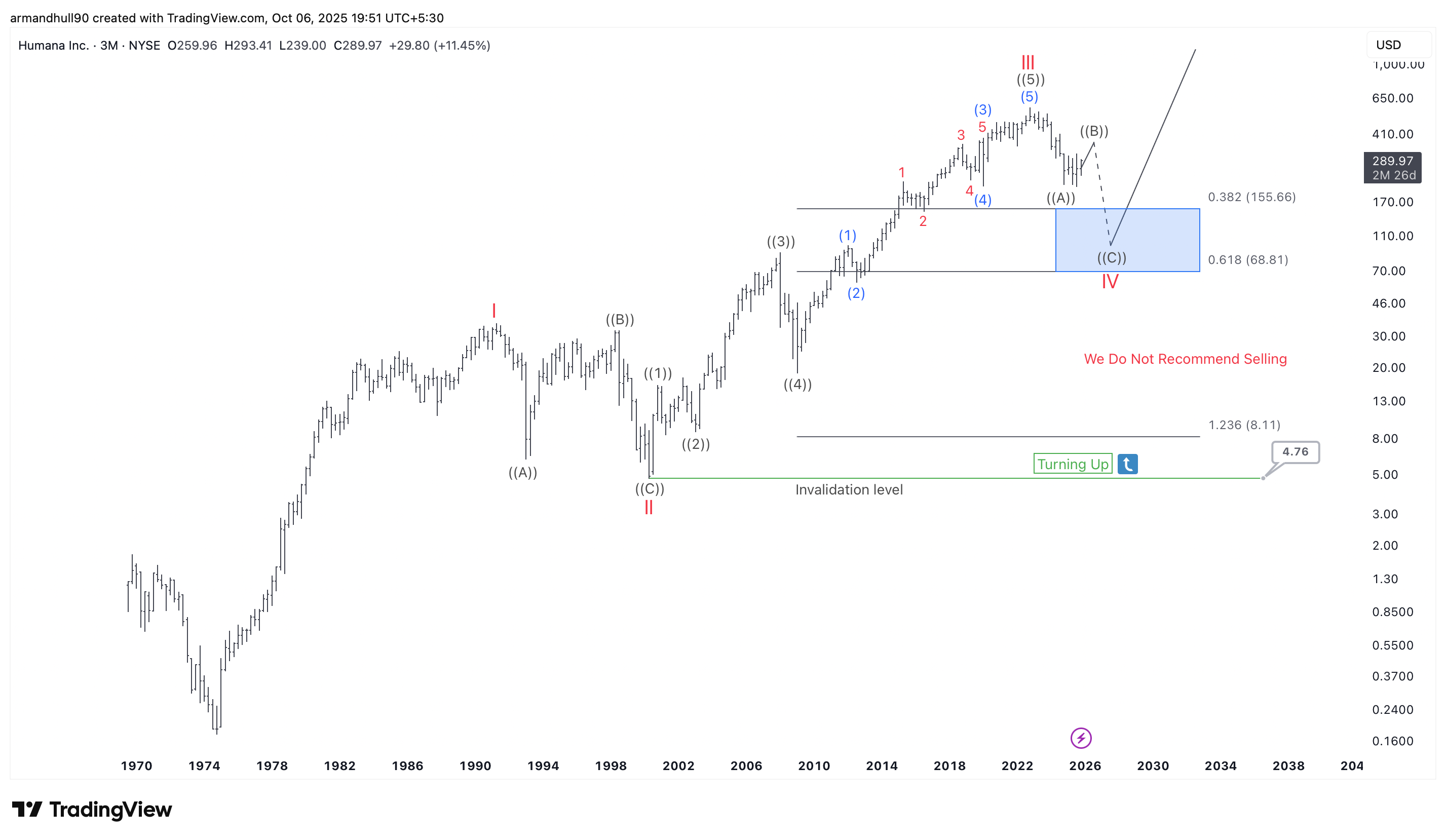

Humana (NYSE: HUM) shows signs that its large wave IV correction is almost complete, hinting at the next major bullish cycle ahead.

Humana Inc. (NYSE: HUM) has spent the last few years correcting after a long and strong rally. The chart shows that the company completed a major five-wave advance from the early 2000s. That move ended in wave III around 2022, marking the top of a powerful bullish cycle.

After the completion of wave III, the market entered a wave IV correction, which is unfolding as a complex (A)-(B)-(C) pattern. In Elliott Wave theory, wave IV typically serves to correct the strong advances of wave III and allows the market to reset before the next rally. This correction often takes more time and can appear choppy or sideways, as we see on Humana’s chart.

So far, wave (A) formed the initial sharp decline, wave (B) created a partial recovery, and now wave (C) is expected to complete the correction inside the blue box between the 0.382 (155.66) and 0.618 (68.81) Fibonacci retracement levels. This blue zone represents the area where buyers usually return, ending the correction and starting a new impulsive phase higher.

The stock currently trades near $290, staying well above the invalidation level at $4.76, which keeps the bullish long-term structure valid. The annotation “Turning Up” reinforces the idea that the market is preparing to resume its uptrend.

Conclusion:

In conclusion, the wave IV correction in Humana seems mature and may soon finish. Once wave (C) completes inside the blue box, the next major wave V rally could begin, aiming for new highs over the next few years. As long as the stock holds above key support, the overall Elliott Wave picture remains constructive — and analysts continue to emphasize, “We do not recommend selling.”