The Indian rupee (USDINR) has faced steady pressure in 2025 due to global uncertainty and rising import costs. Higher oil prices and reduced foreign investment have made the currency weaker. The Reserve Bank of India has limited its support, allowing more market-driven movement. As a result, the rupee has dropped closer to 91 against the U.S. dollar. This trend has raised costs for imported goods and added stress to inflation. Exporters benefit from a weaker rupee, but consumers feel the pinch. Businesses that rely on foreign parts or services also face higher expenses.

Looking ahead to 2026, experts expect the rupee to stay under pressure. If global interest rates remain high, foreign funds may continue to leave India. However, strong service exports and digital growth could help slow the decline. The RBI may act carefully to avoid sharp swings. If India boosts manufacturing and keeps inflation in check, the rupee could find more balance by year-end. Analysts also watch global oil prices and trade deals closely. These factors will shape how the rupee performs in the months to come.

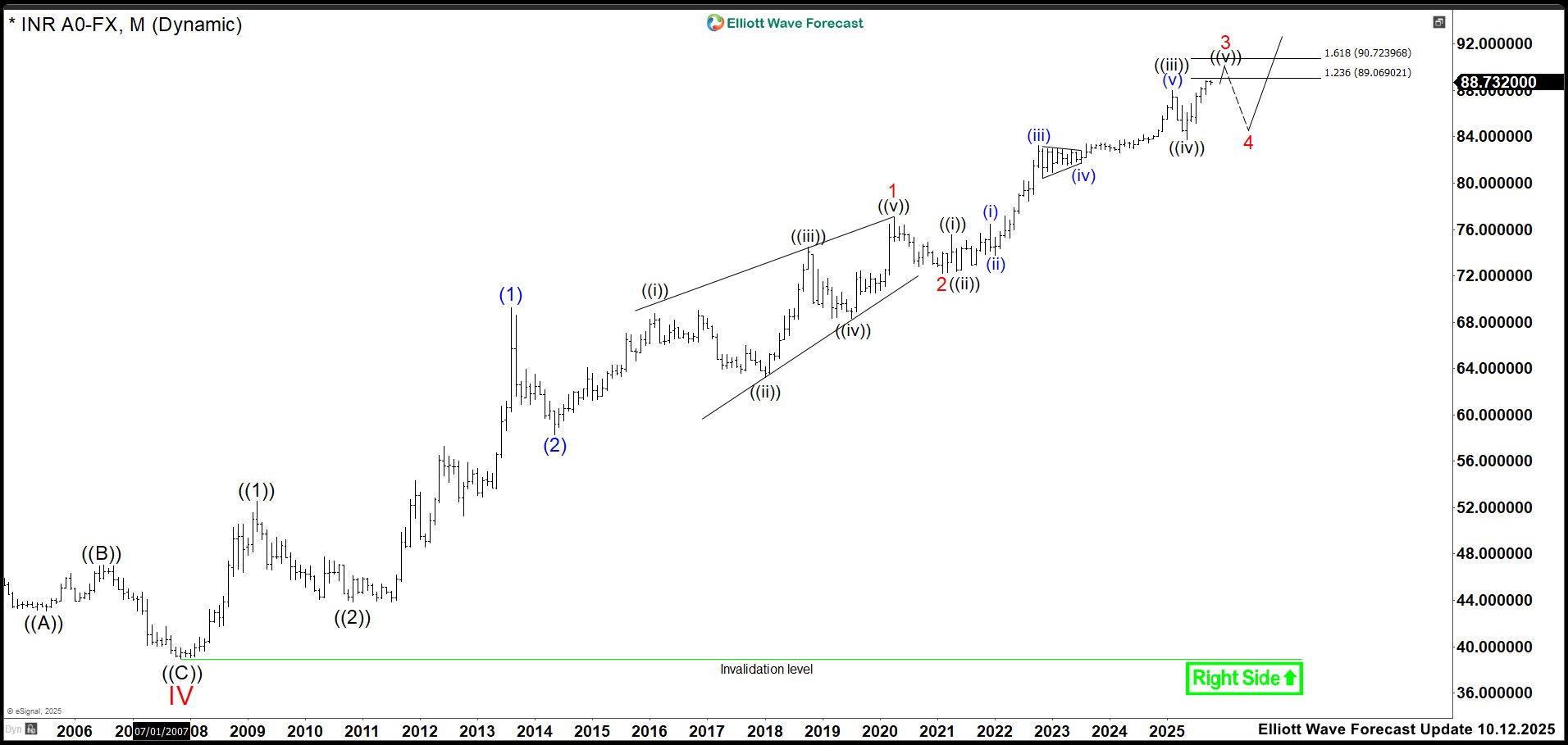

Elliott Wave Forecast: USDINR Monthly Chart May 2025

In the last update, wave (v) of ((iii)) had reached 87.97, missing its target by 29 cents before reversing lower. Wave ((iv)) then corrected sharply, nearly hitting the 100% Fibonacci extension at 83.76, and rebounded with strength—suggesting that wave ((iv)) had likely completed. This setup pointed to a continued rise in USDINR through wave ((v)), with a projected target between 89.06 and 90.72, assuming no further extensions. Cue

Elliott Wave Forecast: USDINR Monthly Chart October 2025

Currently, the rupee is near to reach the extreme area to end wave ((v)) of 3. In that resistance zone, the dollar’s strength was expected to be rejected, marking the end of wave 3 and the beginning of wave 4. Then, that wave 4 would retest the support of wave ((iv)) before wave 5 resumed the bullish trend. This sequence was expected to confirm the broader upward structure and reinforce the long-term bullish outlook for USDINR. Let’s see if there is not an extension in this wave ((v)) of 3 to start a new pullback.

Elliott Wave Forecast: USDINR Monthly Chart October 2025 Alternative

In this alternate scenario, wave 3 had already completed at 87.97, followed by wave 4 ending at 83.76. The market is expected to rise toward the 89.06–90.72 range, completing wave (3) and initiating wave (4), assuming no further extensions. The key difference in this setup is the depth of wave (4)’s correction, which is projected to reach the 2022–2023 triangle support zone between 83.00 and 80.40. This area is likely to hold as support, allowing bullish momentum to resume and carry the market higher. (If you want to learn more about Elliott Wave Principle, please follow these links: Elliott Wave Education and Elliott Wave Theory.)

Source: https://elliottwave-forecast.com/forex/india-rupee-usdinr-pause-renewed-slide/