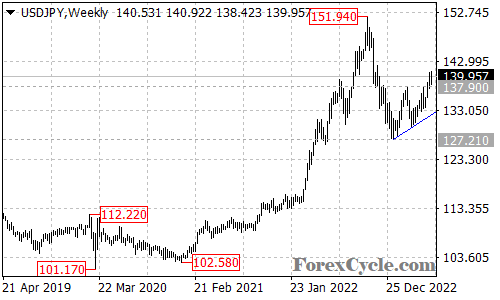

The USDJPY currency pair has shown strong upward momentum, extending its move from 127.21 to reach as high as 140.92. This bullish trend has provided traders and investors with opportunities for potential gains. As the pair continues its upward trajectory, market participants are keeping a close eye on key support and resistance levels to gauge its future direction.

Currently, the USDJPY pair is expected to maintain its bullish bias as long as the 137.90 support level remains intact. This level acts as a crucial marker for the continuation of the upside move. Traders will closely monitor any potential price action near this support level, as a breakdown below it could signal a temporary pause or a potential reversal.

If the upward momentum persists, the next target for USDJPY lies at 142.00. This level serves as an important resistance barrier that could potentially challenge further advances. A breakout above 142.00 would open the door for the pair to target the 145.00 level, presenting an even stronger bullish outlook for the currency pair.

On the downside, if the support at 137.90 is breached, attention will shift to the rising trend line on the weekly chart. This trend line has provided a significant level of support throughout the uptrend, and a break below it would indicate a potential shift in the market sentiment. Such a breakdown could trigger another fall towards the 118.00 area, where further support may be found.