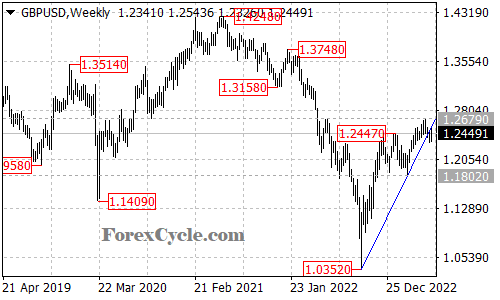

The GBPUSD currency pair has entered a phase of consolidation following the previous uptrend from 1.0352. Traders are closely monitoring the price action, with expectations of a potential decline towards the 1.1800 level over the coming weeks.

While the pair is currently in a consolidation phase, the underlying uptrend remains intact. As long as the key support level at 1.1802 holds, market participants anticipate the resumption of the upside move. A break above the 1.2679 resistance level would provide further confirmation and open the door for the price to reach the next resistance level at 1.3200.

However, before the uptrend can resume, there is a possibility of another downward movement towards the 1.1800 support level. This potential pullback would likely provide an opportunity for traders to reevaluate their positions and potentially enter new long positions at more favorable price levels.

To gain further insights and confirm potential trading opportunities, traders often rely on technical analysis. By studying chart patterns, trend lines, and technical indicators, traders can identify key levels and signals that could validate their analysis. These tools can help traders make informed decisions about entry and exit points, as well as manage risk effectively.