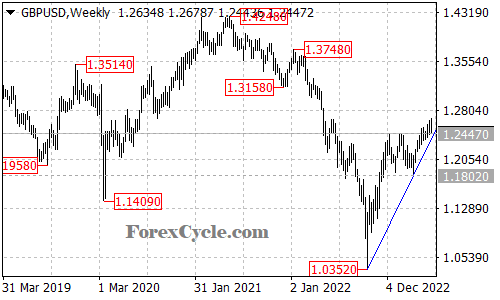

GBPUSD is currently trading near a critical support level, the rising trend line on the weekly chart. The pair has been in a long-term uptrend since hitting a low of 1.0352 in September 2022. As long as this trend line holds, the bullish outlook for GBPUSD remains intact.

However, a breakdown below the trend line support could signal a significant shift in the trend. The next support level for the pair would be at 1.1802, which could provide some temporary relief to the bears. A sustained break below this level would confirm that the long-term uptrend from September 2022 low of 1.0352 has ended.

On the upside, if the trend line support holds, GBPUSD could continue its long-term uptrend, with the next target at 1.3100 area.

Overall, the outlook for GBPUSD remains bullish as long as the rising trend line support on the weekly chart holds. A breakdown below this level, however, would suggest that the long-term uptrend has come to an end, with significant downside potential for the pair. Traders should keep a close eye on this critical support level and monitor price action around it closely.