In the dynamic world of forex trading, understanding and effectively utilizing technical indicators is crucial for making informed trading decisions. One such powerful tool is the Average True Range (ATR). ATR is a widely used indicator that provides valuable insights into market volatility, enabling traders to manage risk and optimize their trading strategies. In this article, we will delve into the concept of ATR, explore its calculation process, discuss its interpretation, and highlight various ways to incorporate ATR into forex trading strategies.

Understanding Average True Range (ATR)

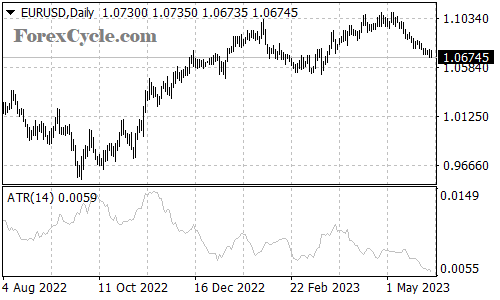

Average True Range (ATR) is a technical indicator developed by J. Welles Wilder Jr. to measure market volatility. Unlike other indicators that focus on price direction or momentum, ATR specifically examines the range of price movement. It represents the average of the true ranges over a specified period, reflecting the overall level of volatility in a given market.

Calculating Average True Range (ATR)

The calculation of ATR involves several steps. First, we need to calculate the True Range (TR), which is the greatest value among three calculations:

- Difference between the current high and low prices.

- Absolute value of the difference between the current high and the previous close.

- Absolute value of the difference between the current low and the previous close.

Once we have the True Range values, we can determine the Average True Range (ATR) by taking the average of the true ranges over a specific period. The most common period used is 14, but traders can adjust it based on their trading style and preferences.

Interpreting Average True Range (ATR)

ATR provides traders with insights into market volatility, allowing them to make more informed trading decisions. Here are a few key ways to interpret ATR:

- Volatility Measurement: A higher ATR value indicates increased market volatility, while a lower ATR value suggests lower volatility. Traders can use this information to adjust their risk management strategies accordingly. For example, during periods of high volatility, they may reduce position sizes or tighten stop-loss orders to protect against potential large swings in the market.

- Stop Loss Placement: ATR can assist in setting appropriate stop-loss levels. By multiplying the ATR value by a certain multiple, traders can determine a suitable distance from the entry point to place their stop-loss orders, taking into account the market’s volatility. This dynamic approach allows traders to adapt their stop-loss levels based on prevailing market conditions.

- Entry and Exit Points: A sudden increase in ATR may indicate the onset of a trending market or a breakout, offering potential entry or exit points for trades. Traders can use ATR to identify optimal price levels for entering or exiting positions. For example, if the ATR value has been relatively low and suddenly spikes, it may suggest a breakout is imminent, prompting traders to consider entering or exiting a trade accordingly.

- Risk Assessment: ATR can help traders assess the risk associated with a particular trade. By comparing the ATR of different currency pairs or assets, traders can choose those with higher or lower volatility based on their risk tolerance and trading strategy. ATR can be used as a tool for portfolio diversification by selecting assets with varying levels of volatility to balance overall risk exposure.

Incorporating ATR into Forex Trading Strategies

ATR can be integrated into various trading strategies to enhance performance and risk management. Here are a few examples:

- Volatility-based Position Sizing: Traders can adjust their position sizes based on the ATR value to account for varying market conditions. Higher volatility may warrant smaller position sizes, while lower volatility may allow for larger positions. This approach ensures that traders align their risk exposure with the current market conditions, preventing excessive losses during highly volatile periods.

- Trailing Stops: ATR can be used to dynamically adjust trailing stops, helping traders lock in profits during volatile market conditions while allowing room for potential further gains. By setting the trailing stop level based on a certain multiple of the ATR, traders can ensure that their positions are protected against adverse price movements while still giving them the flexibility to capture additional profits if the market continues to move favorably.

- Range Breakout Trading: ATR can assist in identifying potential breakout opportunities. Breakouts occur when prices move outside a defined trading range, often indicating a shift in market sentiment and the start of a new trend. Traders can use ATR to set entry and exit levels, aiming to capture significant price movements following a period of consolidation. By analyzing historical ATR values, traders can establish a benchmark for determining the magnitude of a breakout and set appropriate entry and exit points accordingly.

- Volatility Filtering: ATR can be used as a filtering mechanism to identify favorable trading conditions. Traders can compare the current ATR value to historical values and establish thresholds based on their trading strategies. If the current ATR exceeds a specified threshold, it may signal a high probability of profitable trading opportunities. Conversely, if the ATR falls below a certain threshold, it may indicate a lack of favorable trading conditions, prompting traders to reduce their trading activity or focus on alternative strategies.

Conclusion

Average True Range (ATR) is a powerful tool for forex traders seeking to analyze market volatility and make informed trading decisions. By understanding ATR and incorporating it into trading strategies, traders can better manage risk, optimize position sizing, and identify favorable entry and exit points. Remember, like any technical indicator, ATR should be used in conjunction with other analysis techniques to validate signals and create a well-rounded trading approach. With diligent practice and a deep understanding of ATR, traders can enhance their forex trading endeavors and increase their chances of success.