Hello traders. As our members know we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Invesco NASDAQ ETF. Recently the ETF made a clear three-wave correction. The pull back completed as Elliott Wave Double Three pattern and made a decent rally. In this discussion, we’ll break down the Elliott Wave pattern and present targets. Let’s start by explaining the pattern.

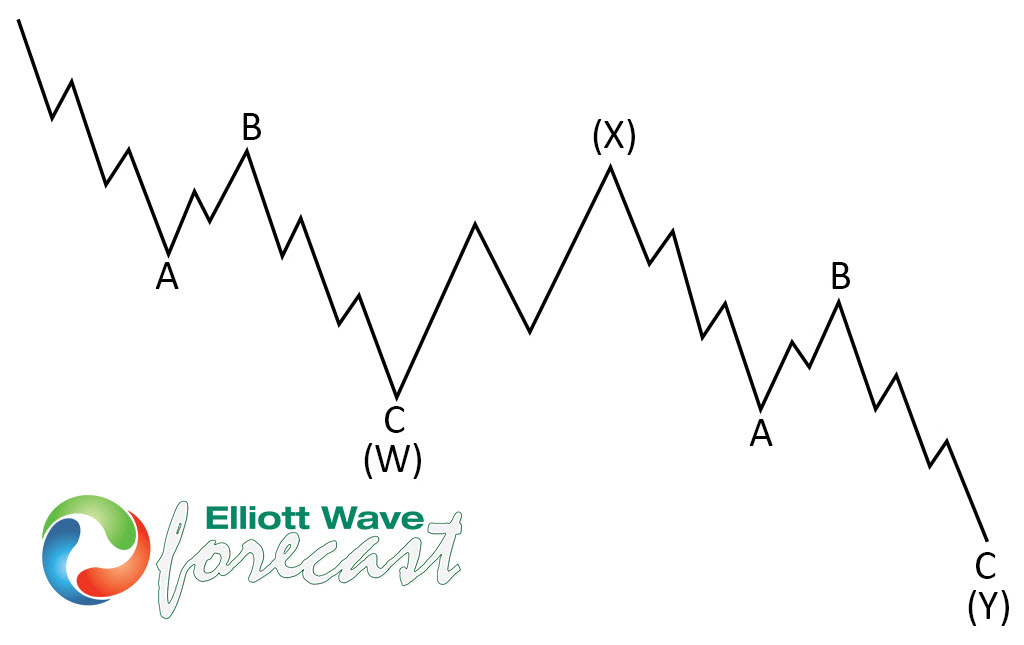

Elliott Wave Double Three Pattern

Double three is the common pattern in the market. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

Now, let’s look at how this pattern appears in a real market example.

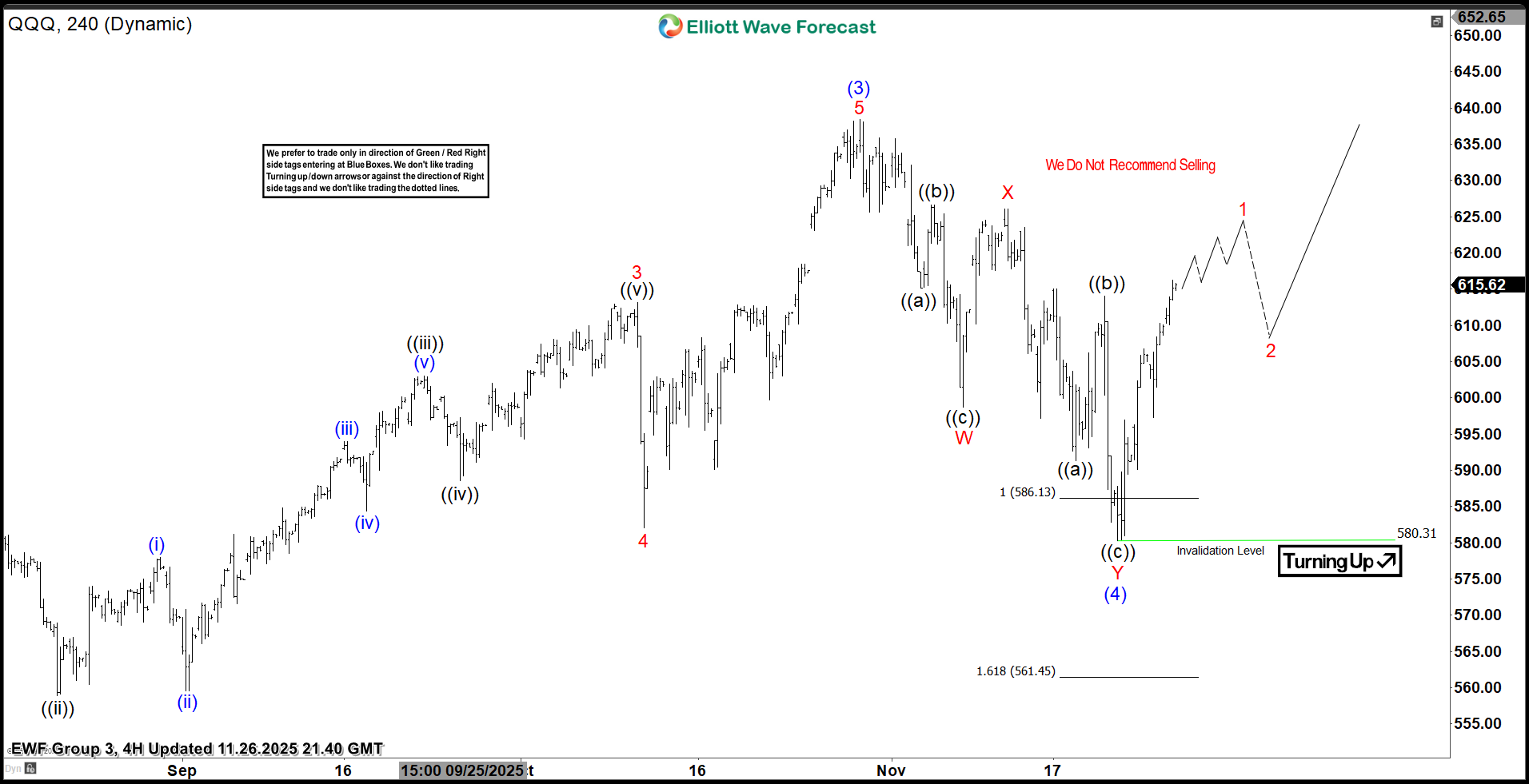

QQQ Elliott Wave 4 Hour Chart 11.18.2025

The ETF is forming a 3-wave pullback, unfolding as a Double Three pattern. At the moment, we can see incomplete sequences in both cycles: from the main peak on October 29th, labeled as wave (3) blue, and from the smaller cycle starting on November 12th, labeled as X red. Our members know that we constantly emphasize the importance of incomplete sequences, as these determine the market’s path.

The structure suggests more weakness toward the Equal Legs area at 586.28–561.62, where we are looking to re-enter as buyers. We expect at least a three-wave bounce from the Blue Box area. Once the price reaches the 50% Fibonacci retracement against the red X connector, we will make the position risk-free by moving the stop loss to breakeven and booking partial profits.

Did you know ? 90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video, available for members viewing inside the membership area.

QQQ Elliott Wave 4 Hour Chart 11.26.2025

QQQ found buyers as expected at the Blue Box area, making decent bounce. While above the last low 580.31 low we count (4) blue correction completed. Wave (5 ) can be in progress toward new highs, targeting 652.32 area.

Reminder for members: Our chat rooms in the membership area are available 24 hours a day, providing expert insights on market trends and Elliott Wave analysis. Don’t hesitate to reach out with any questions about the market, Elliott Wave patterns, or technical analysis. We’re here to help.

Source: https://elliottwave-forecast.com/stock-market/qqq-trading-setup-explained/