Micron Technology MU has surged recently up nearly 7.9% from its previous close. Analysts remain broadly bullish, with Wells Fargo, Mizuho, and UBS all raising price targets into the $265–$300 range, citing strong demand for high-bandwidth memory (HBM) and DRAM pricing momentum. This optimism reflects Micron’s positioning in the AI-driven data center cycle, where memory content growth and disciplined capital expenditure are expected to support margins.

Looking ahead, investors should anticipate continued volatility as the market works through its consolidation phase. Yet the broader trend remains constructive, with Micron’s roadmap for HBM4e and enterprise SSDs positioned to capture expanding demand from AI infrastructure. Once the correction resolves, the transition toward a breakout will be critical. Discipline in waiting for pullbacks offers the higher-probability path, as analysts project Micron’s revenue growth to extend through 2026, reinforcing the case for renewed upside momentum.

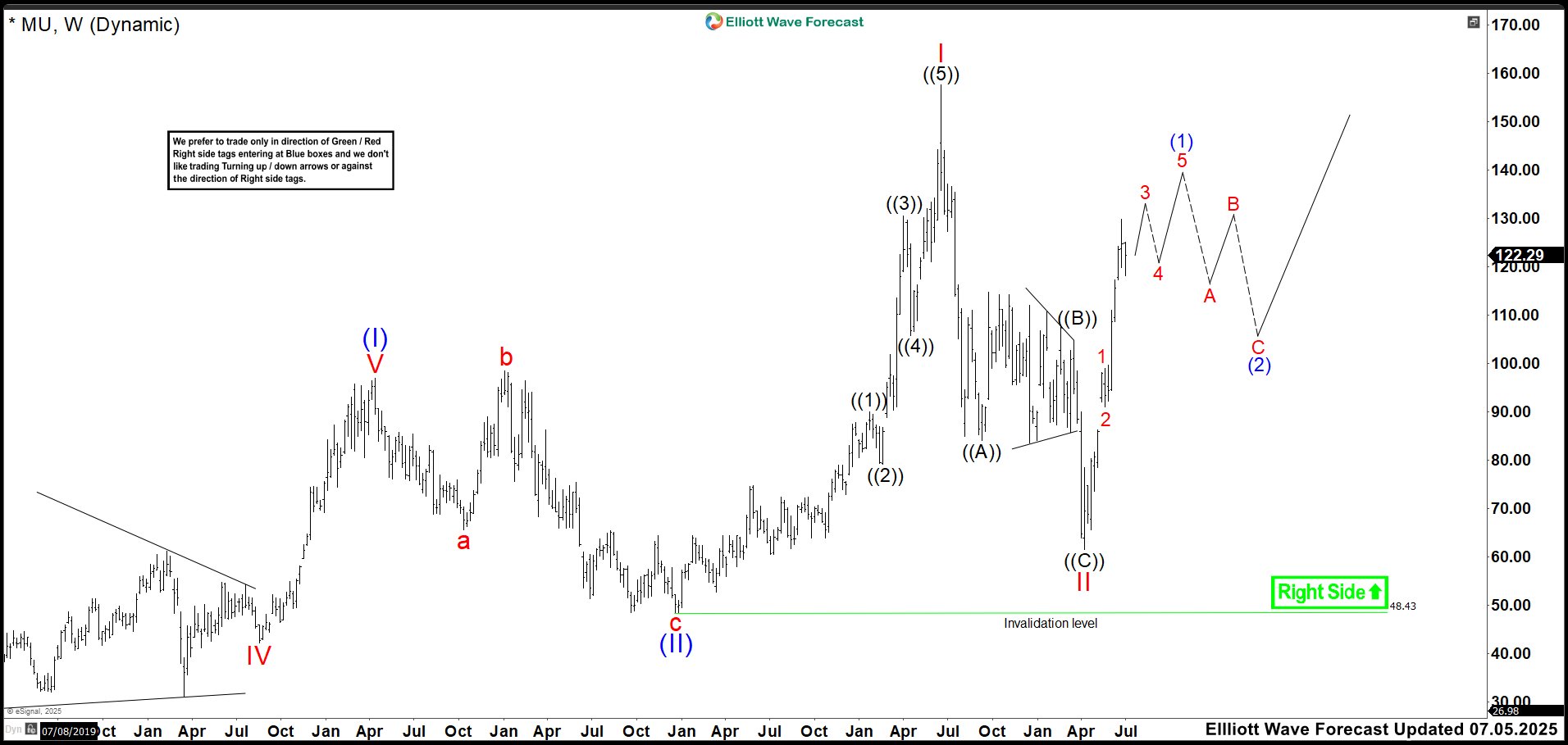

Elliott Wave Outlook: MU Weekly Chart July 2025

Back in July, the market broke below wave (B) at 83.54, confirming that wave ((B)) had already ended. This break coincided with the announcement of new U.S. tariff changes, shifting sentiment and invalidating the anticipated flat. Wave ((B)) ultimately concluded at 104.69 in a triangular formation, which then initiated wave ((C)) of II.

From there, the market declined sharply to 61.54, completing the correction on April 7. Price action then turned decisively bullish, signaling the start of an impulsive advance. Our outlook identified the stock as building wave (1), with price action advancing into wave 3 of (1). At that time, the structure suggested continued upside, though we expected periods of range-bound behavior as wave 3 matured. Ideally, we expected wave 3 to extend into the 132.82–137.41 zone, where a bearish reaction could mark its completion. Following that stage, our expectation was for consolidation before a final rally would complete wave (1) and transition into a corrective phase. (If you want to learn more about Elliott Wave Principle, please follow these links: Elliott Wave Education and Elliott Wave Theory.)

Elliott Wave Outlook: MU Daily Chart November 2025

In this November update, we can see how MU continues to follow an impulsive structure. We adjusted the count by changing (1) to ((1)) and (2) to ((2)). Wave ((1)) ended at the 129.96 high, followed by a correction that reached the 102.94 low. From that point, the extension of wave ((3)) began. As you know, in Elliott Wave theory, wave ((3)) is usually expected to be the strongest, even though this is not a strict requirement for an impulse. The rule is that it cannot be the shortest wave. Indeed, wave ((3)) extended to 261.03 in November, and then, over four days, MU experienced a sharp decline to 192.58, which we identified as wave ((4)). At that stage, many traders assumed a major correction had started; however, it remains possible that MU could still break above the high of wave ((3))

Looking ahead, the minimum target lies at 276.95, and the market could extend higher if momentum continues. The key idea is that MU must break above 261.03 to complete wave ((5)) of III before another significant correction occurs. Importantly, reaching 276.95 does not imply an immediate short‑selling opportunity; rather, it represents a target, not a sell signal. After all, the market may continue its upward trajectory. Therefore, in the next update, we will evaluate whether entering short positions becomes feasible or if the bullish momentum remains dominant.

Source: https://elliottwave-forecast.com/stock-market/micron-mu-rockets-toward-300/