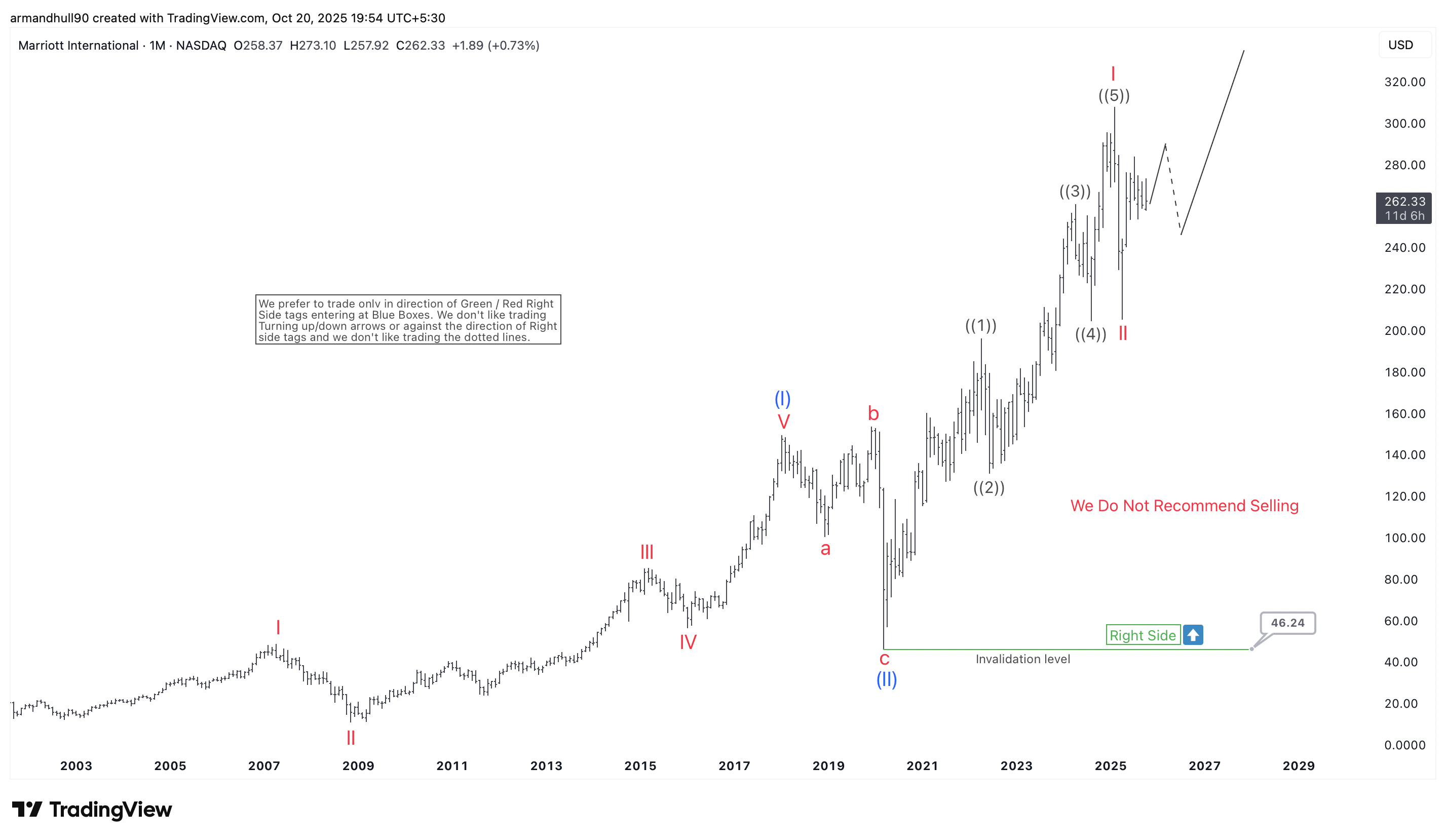

Marriott International Inc. (NASDAQ: MAR) shows a strong long-term bullish setup based on Elliott Wave analysis. The monthly chart indicates that the company has finished a major correction and started a new upward cycle. The structure suggests that Marriott may continue rising in the coming years as global travel demand stays strong.

The rally from the 2009 low formed a clear five-wave pattern, completing wave (I) near the 2018 high. A correction followed between 2018 and 2020, unfolding as an a–b–c structure. This drop completed wave (II) close to $46.24, which now serves as the invalidation level. As long as Marriott stays above this price, the bullish trend remains valid.

After finishing wave (II), Marriott entered a new bullish phase. The next five-wave rally completed wave I of a larger degree (III). The following small correction formed wave II, which appears shallow and controlled. Now, the stock seems to be starting wave III, which is usually the strongest part of an Elliott Wave sequence.

As the price moves higher, the right-side tag on the chart shows a bullish bias. Analysts advise trading only in the direction of the main trend. Selling against it is not recommended. Traders can look for pullbacks to find new buying opportunities instead.

Marriott benefits from a global recovery in travel and tourism. Rising demand for hotels and steady earnings growth give additional strength to its bullish Elliott Wave setup. If the current pattern holds, wave III could extend to new highs in the coming years.

Conclusion

In summary, Marriott International (NASDAQ: MAR) has a clear bullish Elliott Wave structure. The uptrend remains intact above $46.24, and traders may continue to favor long positions while the market supports the “right side” bias.