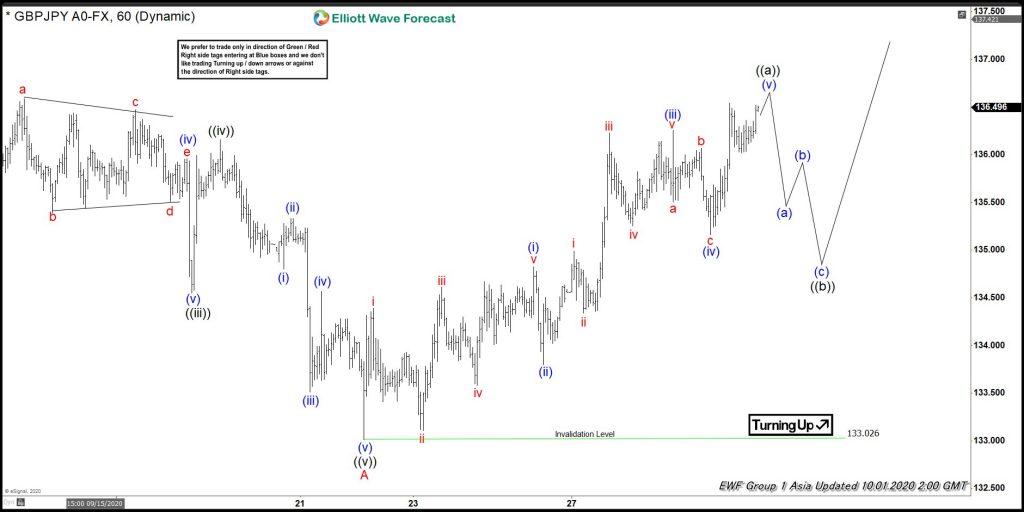

Elliott Wave view in GBPJPY suggests that the decline from 01 September 2020 peak unfolded as 5 waves impulse structure where wave ((iii)) ended at 134.55 low. Wave ((iv)) ended at 136.16 high, and wave ((v)) ended at 133.02 low thus completed wave A. Up from there, the pair is doing a bounce in wave B to correct the cycle from the 9/01/2020 peak as a zigzag structure. When initial rally from the lows is taking place in an impulse structure where lesser degree wave (i) ended at 134.82 high. Wave (ii) ended at 133.80 low, wave (iii) ended at 136.25 high, wave (iv) ended at 135.16 low.

Up from there, wave (v) remains in progress in a lesser degree 5 wave structure & expected to reach a minimum extension area towards 136.51- 136.91 area (inverse 1.236%-1.618% ext area) before ending 5 waves within wave ((a)). In case of further extension area in wave (v) the pair can even see (v)=(i) target area as well towards 136.96-137.39 area before entering wave ((b) pullback. Near term, the pullback in wave ((b)) is expected to find support in 3, 7, or 11 swing against 133.02 low for further upside in the pair.

GBPJPY 1 Hour Elliott Wave Chart