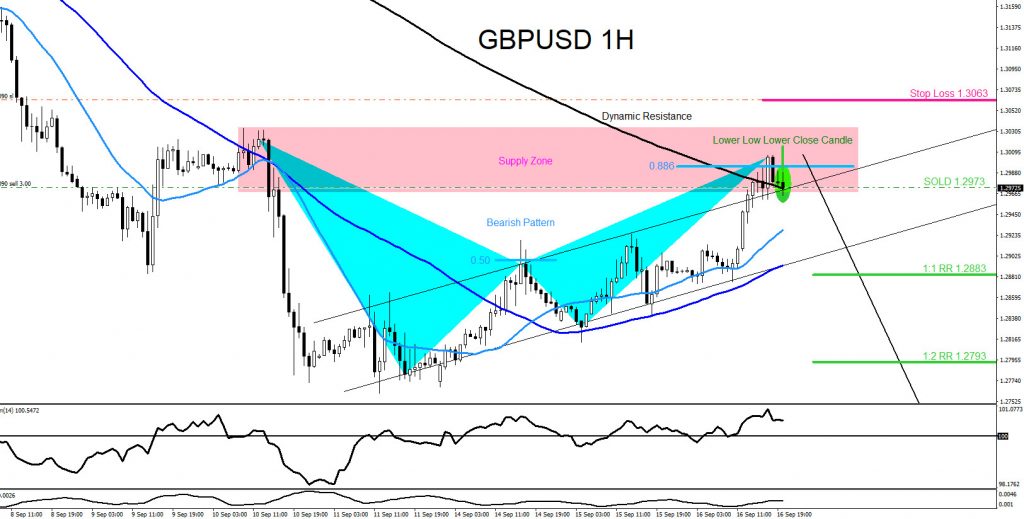

On September 16 2020 I posted on social media Stocktwits/Twitter @AidanFX “GBPUSD Watch for selling opportunities as long price stays below 1.3060.” The chart below of the GBPUSD pair was also posted on social media StockTwits/Twitter @AidanFX September 16 2020 showing that a bearish market pattern (light blue) formed and triggered SELLS at the 0.886% Fib. retracement level. The bearish pattern (light blue) also triggered SELLS in a key resistance zone (pink) which was clearly visible and signalled to traders to look for only selling opportunities. I called for traders to SELL GBPUSD and only a move above the pink resistance zone would invalidate the SELL trade setup. Stop loss was set above this zone targeting the green 1:1 RR and 1:2 RR targets.

GBPUSD 1 Hour Chart September 16 2020

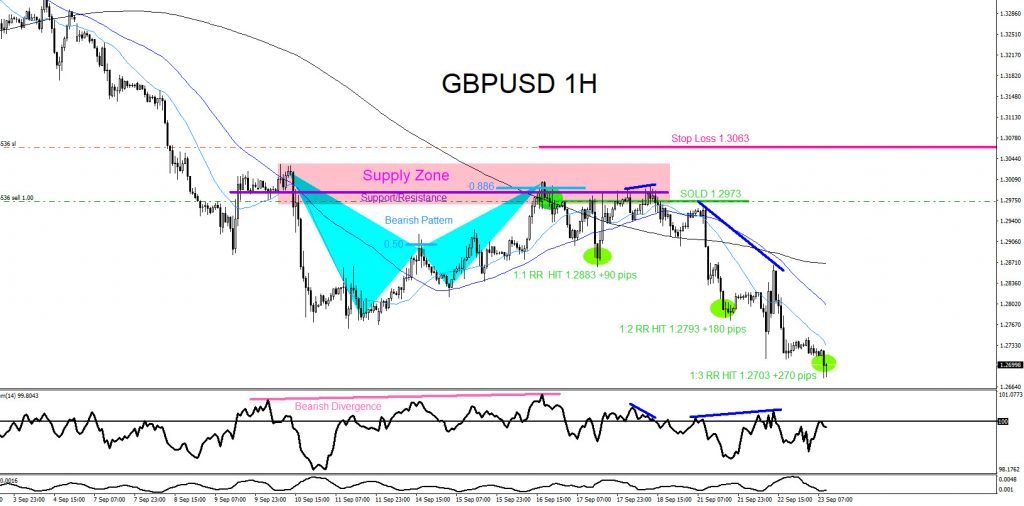

GBPUSD eventually moves lower and on September 23 2020 price hits the 1:3 RR target at 1.2703 from 1.29973 for +270 pips. The chart below also displays bearish divergence patterns before the decline and during the move lower. If you followed me on Twitter/Stocktwits @AidanFX you too could have caught the GBPUSD move lower.

GBPUSD 1 Hour Chart September 23 2020

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX