Chipotle Mexican Grill (NYSE: CMG) has been able to adapt within the current pandemic situation by adjusting its operations to handle digital orders and and made deliveries.

Last week , the stock hit a record high, going over $1,000 per share for the first time and it’s currently up 125% since the March bottom. The technical outlook for CMG was strongly bullish since last year as CMG rallied into new all time highs by breaking above 2015 peak which created a bullish sequence with a minimum target at $965.

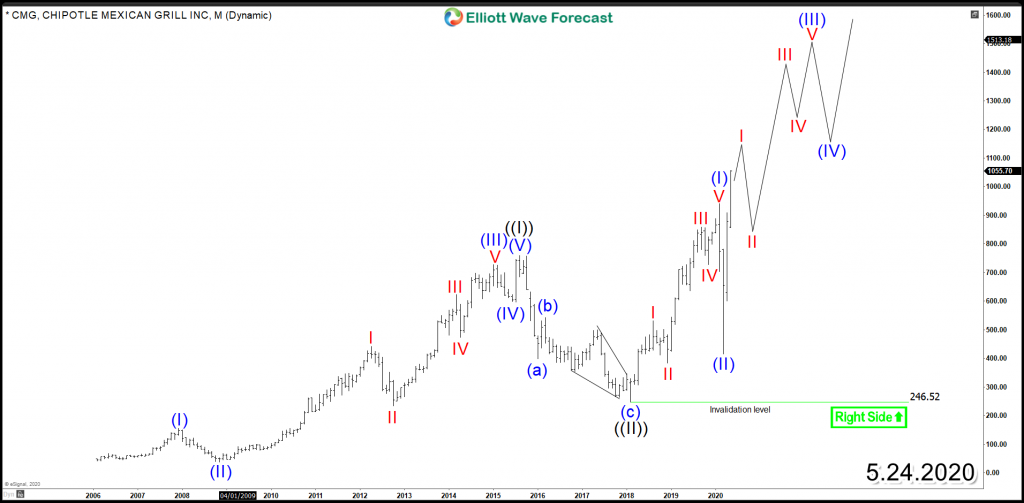

The impulsive 5 waves advance since IPO was the key for the stock to remain supported and looking for a similar path to the upside after taking 2015 peak to refresh the bullish trend. Consequently, CMG is currently looking for a similar path to take place from 2018 low as the stock is trading higher within a strong 3rd wave within the Grand Super Cycle.

Chipotle Mexican Grill – CMG – Monthly Chart

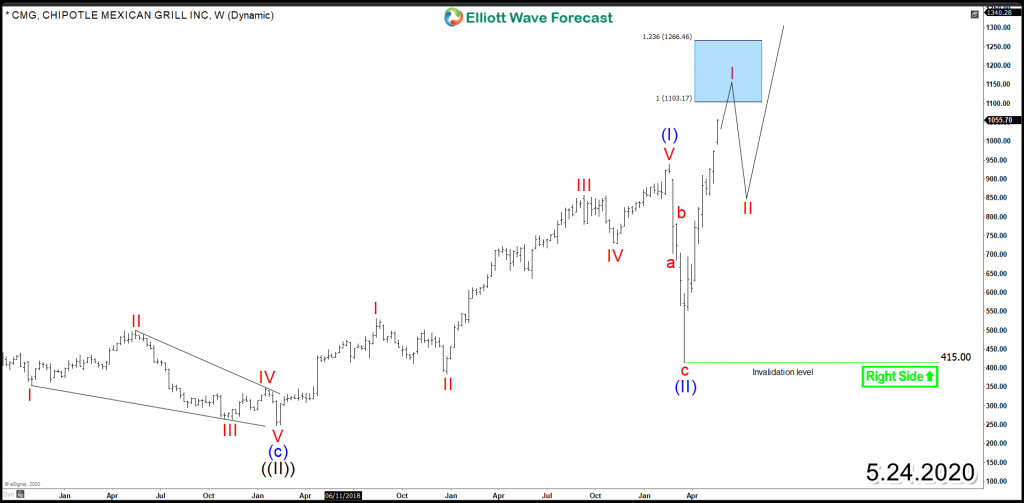

Based on Elliott Wave Theory, after every 5 waves advance, a correction in 3 waves takes place before the resumption of the main trend which is the main reason the market doesn’t run within a straight line. Currently, the rally which started back in March 2020 is aiming for an initial target at equal legs area $1103 – $1266 which can see Bulls taking profit causing a 3 waves pullback in a potential wave II of (III) before the stock will find buyers again to be able to resume the rally.

The Mexican-food restaurant chain bullish structure is providing an edge for investor and allowing traders to join the trend during Daily pullbacks as long as $415 will remain in place. The next correction will be so important for the stock to define the next key levels to trigger more momentum into the weekly cycle.

Chipotle Mexican Grill – CMG – Weekly Chart