Union Pacific Railroad (NYSE:UNP) is a publicly-traded railroad holding company that was established in 1969 . Last year, revenues grew to $22.8 billion, while earnings was up in mid-single-digits to $10.8 billion. Revenue growth was led by strong gains in Intermodal, amid capacity constraints in the trucking industry and a higher industrial production for commodities shipments.

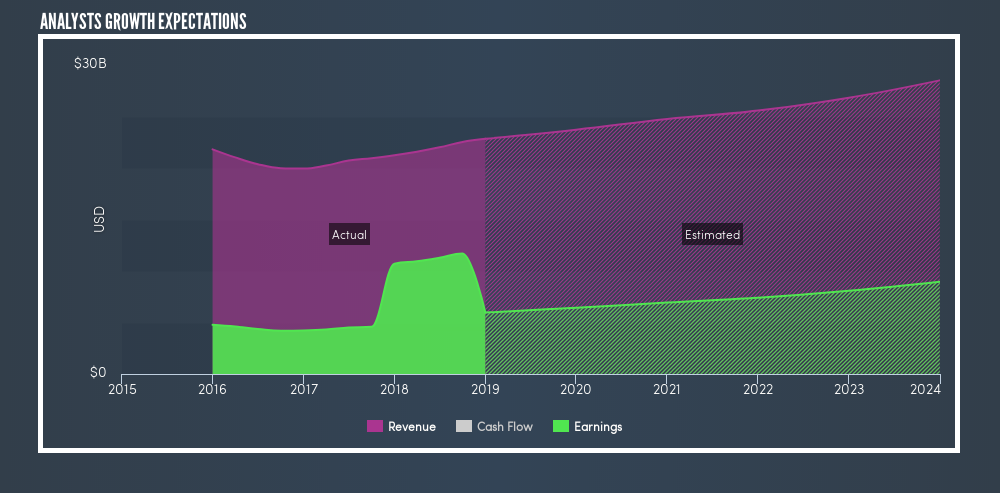

Union Pacific’s year on year earnings growth rate has been positive over the past 5 years and it outperformed the Transportation industry. Its earnings are expected to grow by 7.1% yearly and revenue is expected to grow by 4% yearly.

UNP Future Revenue and Net Income Expectation

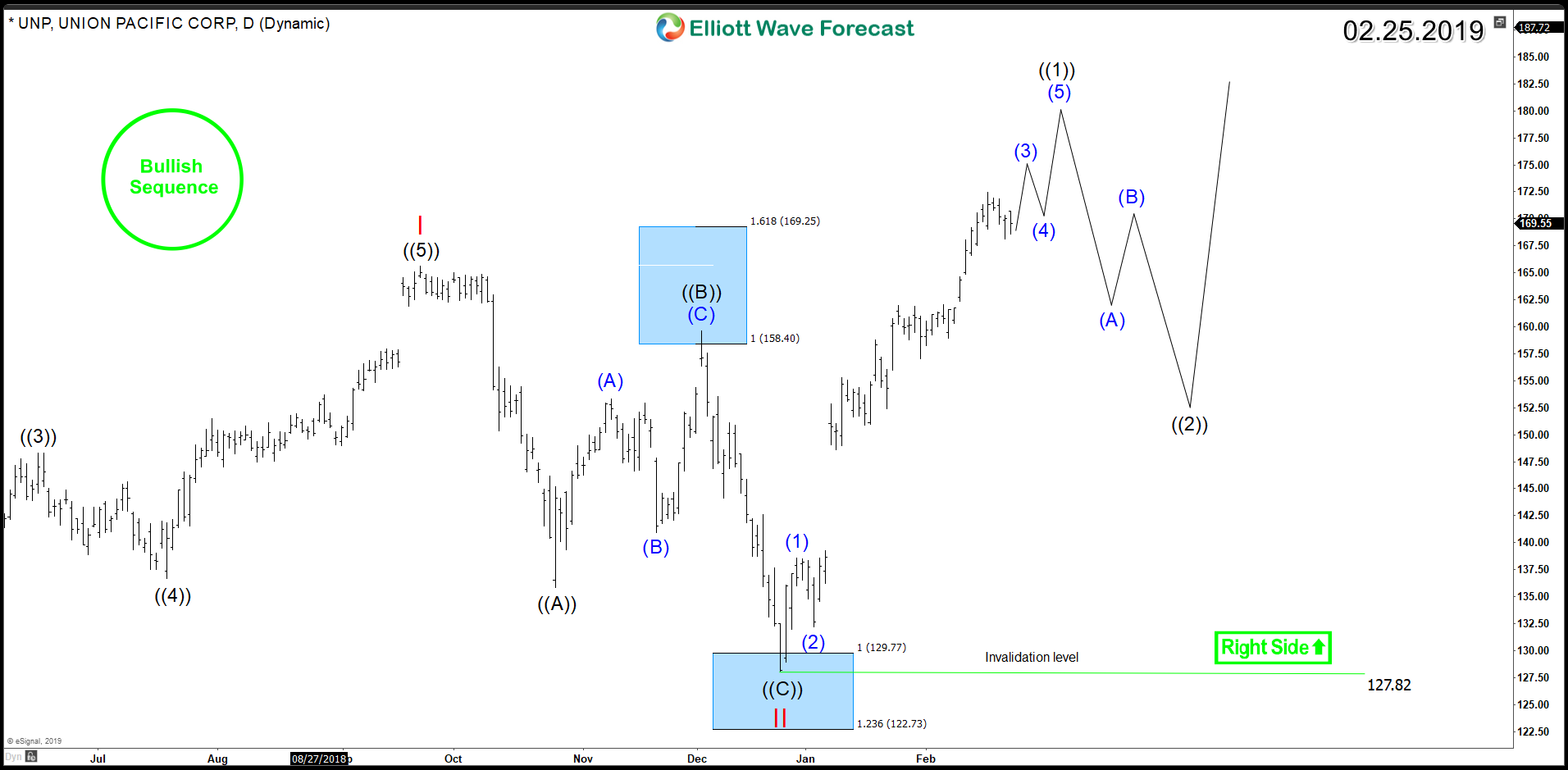

Moving on to the technical picture of the stock using weekly and daily Elliott wave chart :

From January 2016 low, UNP rallied higher in an impulsive 5 waves advance breaking 2015 peak which opened a new bigger cycle to the upside. The 5 waves rally ended as a wave I in September 2018 then did a 3 waves pullback Zigzag Structure in wave II which reacted higher from the blue box area $129 – $122.

Up from there, the stock resumed the rally breaking to new all time highs and opening a new bullish sequence to the upside calling for a move toward target area $226 – $287. Therefore, UNP pullbacks are expected to remain supported above December 2018 low $127 and find buyers in 3 , 7 or 11 swings.

UNP Elliott Wave Daily Chart

UNP Elliott Wave Weekly Chart

Conclusion

UNP bulls are looking to stay in charge as the stock has a bullish sequence from 2016 and 2018 lows so Investors may be looking ahead to the next couple of weeks for buying opportunities during the coming pullbacks