Short term NIFTY Elliott Wave view suggests the rally to 9709.3 ended Intermediate wave (1), and the pullback to 9449.06 low ended Intermediate wave (2). Intermediate wave (3) is unfolding as an Elliott wave double three structure where Minor wave W of (3) is currently in progress towards 9894.8 – 9954.5.

Up from 6/30 low at 9449.06, Minor wave W of (3) is unfolding as an Elliott Wave double three structure where Minute wave ((w)) ended at 9700.7 and Minute wave ((x)) ended at 9642.65. Wave ((y)) is in progress also as a double three structure where Minutte wave (w) ended at 9830.05, and Minutte wave (x) pullback is proposed complete at 9778.85.

Near term focus is on 9894.8 – 9954.5 to complete Minor wave W and end cycle from 6/30 low. Afterwards, Index should pullback in Minor wave X in 3, 7, or 11 swing to correct cycle from 6/30 low before the rally resumes. We don’t like selling the Index and expect buyers to appear once wave X is complete provided pivot at 9449.06 stays intact.

NIFTY 1 Hour Elliott Wave Chart

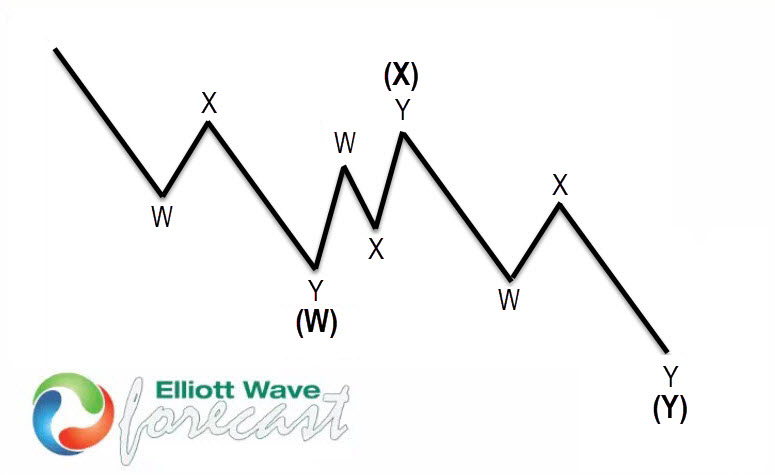

WXY (double three) is one of the most common patterns in the theory of New Elliott Wave. This structure is commonly called double three Elliott Wave pattern. Market shows this structure very frequently nowadays in many instruments in almost all time frames. It is a very reliable structure by which we can make a good analysis. What is more important is it can give us good trading inputs with clearly defined levels of invalidation and destination areas.

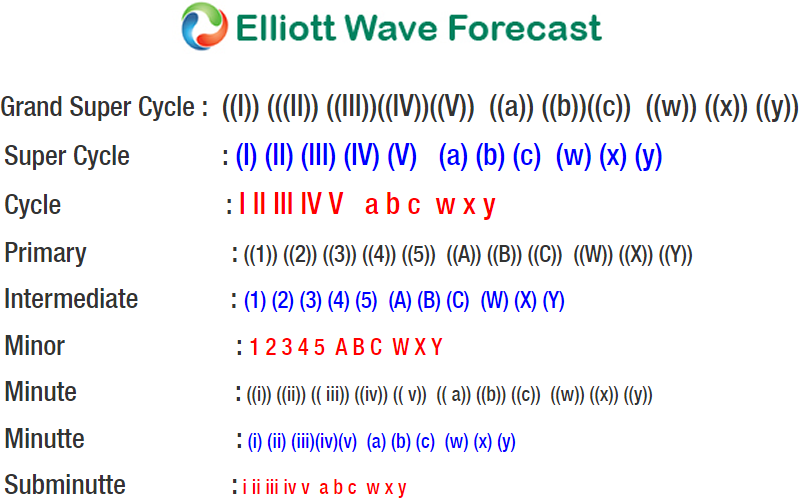

The image above shows what Elliott wave Double Three pattern looks like. It has (W), (X), and (Y) labelling and 3,3,3 internal structure. This means that all these 3 legs are corrective sequences. Each (W), (X) and (Y) is subdivided into three waves, and they commonly subdivide in the structure of W, X, Y in the lesser degree as well. Elliott Wave principle is a form of technical analysis that traders use to analyze the cycles of financial markets and market trends forecast by identifying extremes in investor psychology, high and low prices, and other collective factors. Important to Note that 3 waves could also be labeled as ABC (5-3-5) structure.

Source : https://elliottwave-forecast.com/stock-market/nifty-elliott-wave-view-resuming-higher