McDonald’s (MCD) stock has faced short-term pressure, dropping about 2% recently, yet its fundamentals remain strong. The company continues to benefit from its global franchising model, which delivers high margins and stable cash flow. Moreover, analysts highlight that despite inflationary challenges, McDonald’s has maintained revenue growth and resilient consumer demand. Transitioning into the next quarter, investors should expect moderate volatility, as forecasts show the price fluctuating between $279 and $336 before stabilizing near $303. This range reflects both inflationary risks and the company’s ability to sustain profitability through menu innovation and operational efficiency.

Looking further ahead, Wall Street maintains a consensus “Hold” rating, with 11 analysts recommending “Buy” and 15 suggesting “Hold”. Importantly, the average price target of $324 implies a 4% upside from current levels, while long-term projections anticipate gradual growth into 2026 and beyond. Therefore, while short-term headwinds may limit sharp gains, McDonald’s remains positioned as a defensive stock in the consumer sector. Investors should watch for upcoming earnings reports and consumer spending trends, as these will likely determine whether MCD consolidates near $300 or begins a gradual climb toward its forecasted targets.

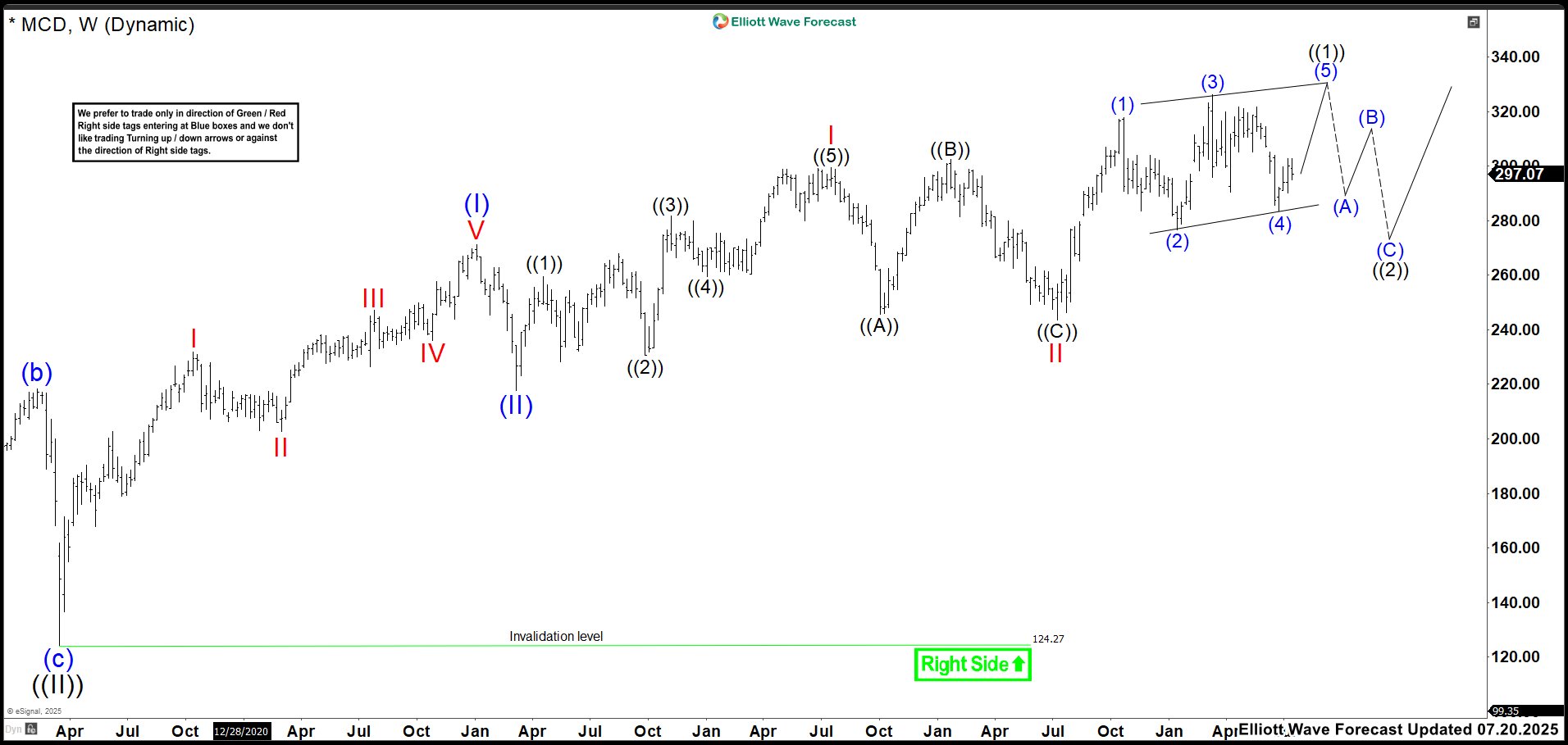

Elliott Wave Outlook: McDonald’s MCD Weekly Chart July 2025

Last time, we noticed that wave (2) unfolded with far more duration than we had expected. At first, we leaned toward a strong bullish continuation, but as the structure matured, we chose to relabel it as a leading diagonal. That adjustment came after we recognized the Dow Jones was likely approaching the end of an impulsive move that had started back in April. With that in mind, we expected McDonald’s (MCD) to rally before giving way to a pullback.

As we mapped the diagonal, we marked wave (1) at the 317.84 high, correction wave (2) at the 276.63 low, the next leg at the 326.27 high, and wave (4) at the 283.47 low. To complete the pattern, we projected wave (5) to rise above wave (3) but remain capped beneath 333.27

If you’d like to deepen your understanding of Elliott Wave Theory, explore these resources: Elliott Wave Education and Elliott Wave Theory

Elliott Wave Outlook: McDonald’s MCD Weekly Chart December 2025

After several months, price action has remained stable without any variation. Consequently, this stability may suggest that the market is forming either a triangle or a bullish nest. We will adopt the triangle scenario, since we still believe the markets are close to completing the April cycle. If this is the case, MCD would bring a correction represented on the chart as wave ((2)).

Meanwhile, because we are still looking one further high to complete wave ((1)), we expect the market to stay above 283.63 low. This level supports our primary idea of aiming for another high around 336.36. Finally, we look for a bearish reaction from the market, which would signal that wave ((1)) may have already ended and announce the beginning of a possible correction.

Source: https://elliottwave-forecast.com/stock-market/mcdonalds-mcd-lagging-burn-bounce-back/