Hello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of Dollar Index DXY published in members area of the website. As our members know, DXY is forming a correction against the 103.56 peak. In the following text, we’ll explain the Elliott Wave analysis and outline the target areas.

DXY Elliott Wave 1 Hour Chart 04.28.2025

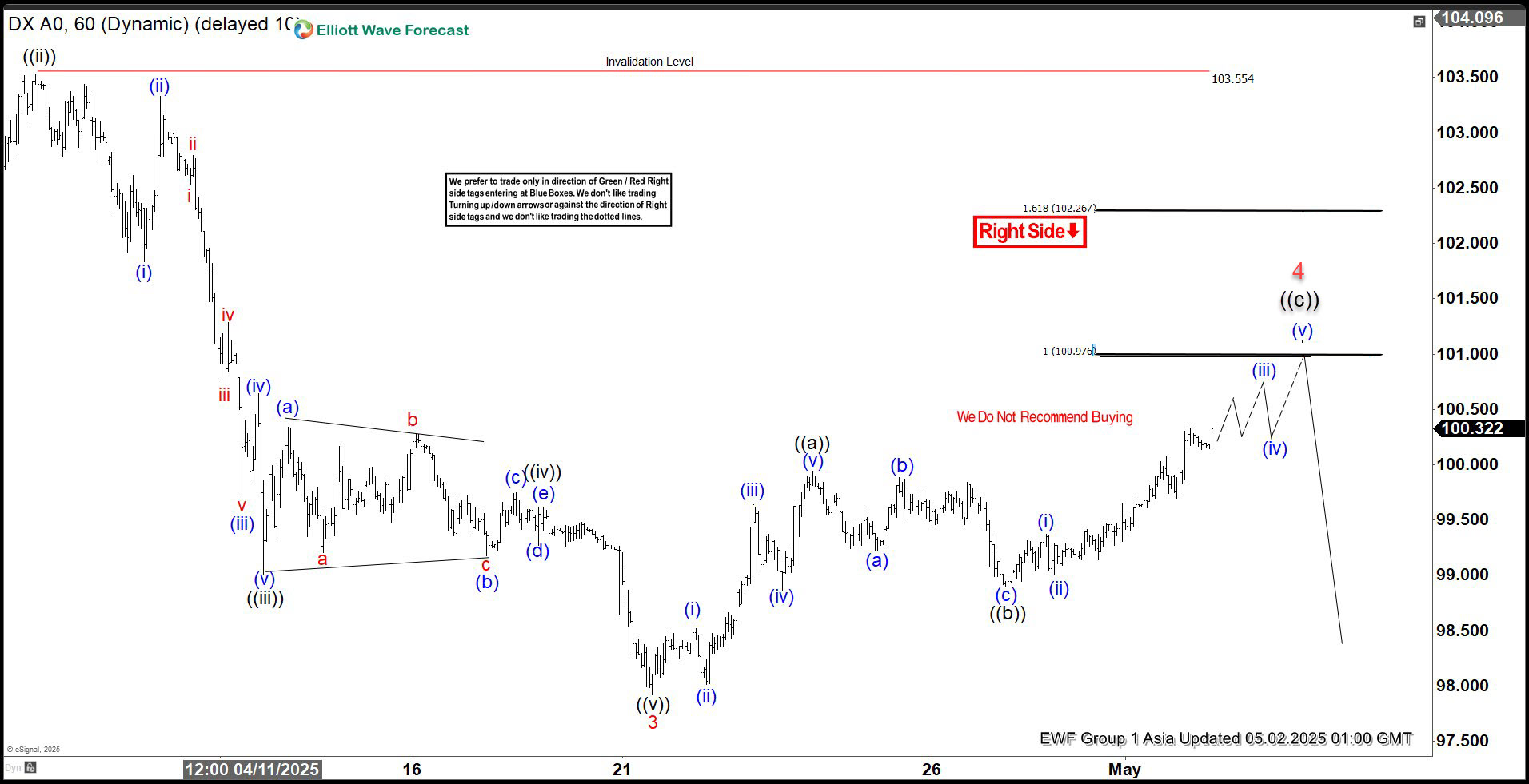

The current view suggests that the US Dollar Index is correcting the cycle from the 103.56 peak.We count five waves in the rally from the low, indicating that we have completed only the first leg of a potential correction, labeled as wave ((a)) in black.

The market is currently forming wave ((b)), which could reach the 99.18–98.75 area.In this zone, we expect buyers to appear for a potential final push higher in wave ((c)), as proposed on the chart.

New to Elliott Wave? You can learn more about Elliott Wave Patterns at our Free Elliott Wave Educational Web Page

90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

DXY Elliott Wave 1 Hour Chart 04.28.2025

Dollar found buyers at 99.18–98.75 area as expected. It made decent rally that broke the previous peak ((a)) , confirming that the next leg up is in progress – ((c)). Dollar can see 100.97-102.26 area before sellers appear again.

Remember, the market is dynamic, and the presented view may have changed in the meantime. For the most recent charts and target levels, please refer to the membership area of the site. The best instruments to trade are those with incomplete bullish or bearish swing sequences. We put them in Sequence Report and best among them are presented in the Live Trading Room

Reminder for members: Our chat rooms in the membership area are available 24 hours a day, providing expert insights on market trends and Elliott Wave analysis. Don’t hesitate to reach out with any questions about the market, Elliott Wave patterns, or technical analysis. We’re here to help.

Source: https://elliottwave-forecast.com/elliottwave/dollar-index-dxy-elliott-wave-zig-zag-2/-elliott-wave-zig-zag-2/