EURUSD has been navigating an uptrend, but recent price action suggests a potential shift. This analysis examines the technical outlook and explores potential scenarios for the currency pair.

Uptrend on Hold: Consolidation Phase Emerges

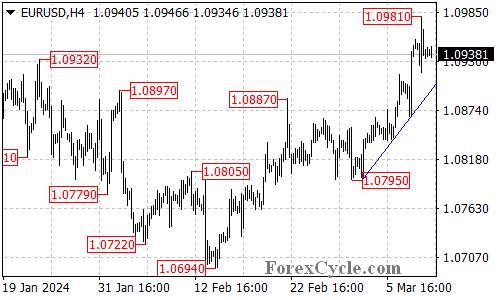

- Rising Trend Line Intact: EURUSD remains above the rising trend line on the 4-hour chart, indicating the uptrend that began at 1.0795 is still technically in play.

- 1.0981 High Reached: The uptrend recently extended to a high of 1.0981.

- Pullback Signals Consolidation: However, a subsequent pullback suggests a period of consolidation for the uptrend is underway. This means the price may trade sideways within a defined range for some time.

- Rangebound Trading Expected: In the coming days, we may see range trading between 1.0900 as support and 1.0981 as resistance.

Upside Potential Remains:

- Uptrend Resumption: As long as the price stays above the rising trend line, the uptrend could resume. A further rise towards the 1.1050 area is still possible after a successful breakout from this consolidation phase.

Key Support to Watch:

- 1.0900 Breakdown Critical: The key support level to watch is at 1.0900. A breakdown below this level could signal a break of the consolidation and trigger a further downside move towards 1.0850.

Overall Sentiment:

The technical outlook for EURUSD is currently uncertain. While the uptrend remains intact on the longer timeframe, the recent consolidation phase suggests a potential pause or even a reversal if support breaks. Close attention should be paid to the price action around the mentioned support and resistance levels to determine the future direction of EURUSD.