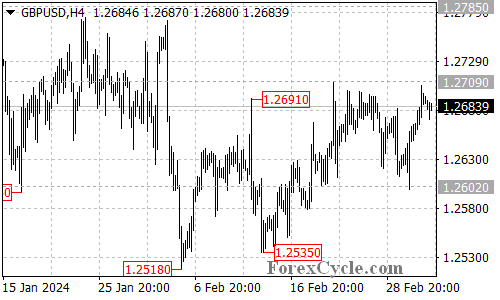

GBPUSD is currently facing resistance at the 1.2709 level. This analysis will delve into the potential implications of a breakout or breakdown from this key level, exploring both upside and downside scenarios for the currency pair.

Resistance in Focus: Can the Bulls Break Higher?

- 1.2709 Resistance: A crucial hurdle awaits GBPUSD at the 1.2709 level. If the bulls can overcome this resistance decisively, it would be a bullish signal. This breakout could open the door for further appreciation, potentially leading the price towards the next resistance level at 1.2785.

- Beyond 1.2785: Reaching for the Highs?: A surge above 1.2785 could pave the way for a rise towards the 1.2827 level, which represents the December 28, 2023 high. This would signify a significant bullish development and potentially solidify the uptrend.

Support Levels to Watch: Potential Downturn Scenarios

- 1.2655 Initial Support: If the bulls fail to breach 1.2709 and the price falls back, the initial support level to watch is at 1.2655. A breakdown below this level could trigger further downside, potentially leading to a retest of the 1.2600 support level.

- 1.2600 and Below: Reversal Signal?: A decisive break below the 1.2600 support level would be a significant development. This could signal a completion of the recent uptrend and potentially lead to a deeper decline towards the 1.2500 level, marking a possible trend reversal.

Overall Sentiment:

The technical outlook for GBPUSD is currently uncertain. While holding above the initial support level of 1.2655 offers some hope for the bulls, a confirmed breakout above 1.2709 is needed to establish a clear bullish direction. Conversely, a breach of key support levels could indicate a potential trend reversal. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.