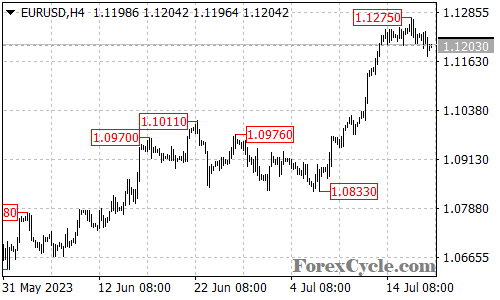

The EURUSD currency pair has recently experienced a significant development, as it broke below the key support level at 1.1203. This breach suggests that the upside move that began from 1.0833 and led the pair to reach 1.1275 has potentially come to an end. Traders are now closely observing the price action, as a deeper decline could be in the cards for the coming days.

Bearish Momentum in Play:

With the breach of the 1.1203 support level, bearish momentum has intensified in the EURUSD pair. This breakdown indicates that sellers have gained control, and it opens the possibility of further downside movement. Traders will be watching for confirmation of the bearish sentiment through factors such as increased selling pressure, bearish candlestick patterns, and potential bearish technical indicators.

Next Target at 1.1000:

Given the downside momentum, the next target for EURUSD lies at the psychological level of 1.1000. This level is likely to attract attention from traders, and it could serve as a significant support zone. A successful break below 1.1000 could potentially lead to more extensive declines, while a bounce from this level might trigger some short-term consolidation.

Resistance at 1.1275:

On the upside, the 1.1275 level now acts as a critical resistance. If EURUSD manages to reclaim this level and hold above it convincingly, it could indicate a potential reversal of the recent bearish move. Traders would then look for a potential retest of higher levels, with 1.1500 being the next significant resistance to watch.

In conclusion, the EURUSD pair has broken below the critical support level at 1.1203, indicating a potential end to the recent upside move. Traders will closely monitor the price action for further confirmation of the downside momentum. The next target for the pair is around 1.1000, while a break above the resistance at 1.1275 could signal a potential reversal.