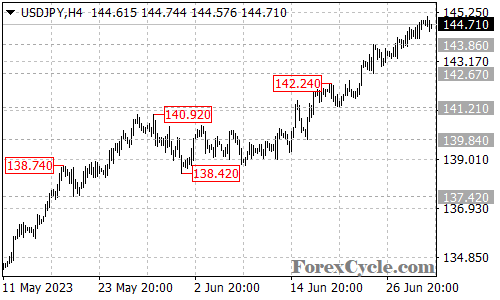

The USDJPY pair has experienced a remarkable upside move from its starting point at 138.42, reaching as high as 145.06. This rally demonstrates the strength and resilience of the USDJPY uptrend. Traders are now closely monitoring the potential for further appreciation in the pair.

Market participants are now looking towards the next target level for USDJPY, which is situated at 146.40. A successful breach above this level could pave the way for the pair to reach 149.00, marking a significant milestone in the ongoing bullish trajectory.

Immediate support for USDJPY can be found at 143.86. If the price retreats from its current levels, a dip towards this support level may be observed. A break below 143.86 could potentially lead to a retest of the lower support level at 142.67. In the event of a breakdown below this level, it could signal the completion of the current uptrend, with the pair finding further support at 141.21.

In summary, USDJPY continues to display a robust upward trend, with the potential for further gains in the near term. The next target level of 146.40 and a subsequent milestone at 149.00 are on traders’ radars. Immediate support levels are identified at 143.86 and 142.67, serving as key reference points. Traders should closely monitor market conditions, economic developments, and evolving sentiment to adjust their strategies accordingly and capitalize on potential opportunities in the USDJPY market.