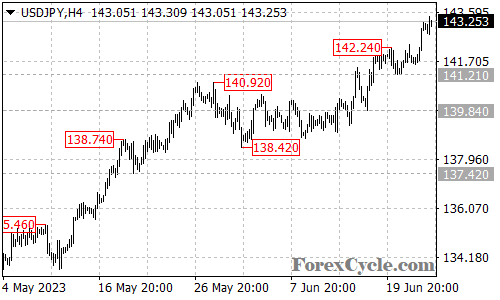

The USDJPY currency pair has continued its impressive upside move, reaching as high as 143.31. This upward momentum suggests that the pair remains in a strong uptrend, and there is a possibility of further gains in the near future.

Looking ahead, the next target for USDJPY is projected to be around the 145.00 area. This level represents a significant resistance zone where sellers may attempt to halt the upward momentum and trigger a corrective pullback. Traders should closely monitor price action around this level for potential signs of a reversal or consolidation.

On the downside, immediate support levels are located at 142.24 and 141.21. These levels act as important barriers that would need to be broken to indicate a potential completion of the current uptrend. A break below these support levels could lead to a shift in momentum and potentially open the door for a deeper correction.

In summary, USDJPY continues to exhibit strong upside momentum, and further gains towards the 145.00 area are possible. Traders should closely monitor potential resistance around this level for any signs of a reversal. Support levels at 142.24 and 141.21 should be monitored for potential shifts in momentum. Stay informed and adapt trading strategies accordingly to navigate the evolving market conditions.