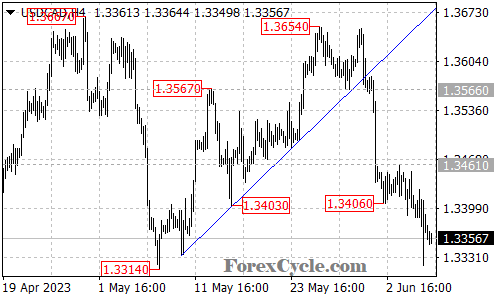

The USDCAD currency pair has experienced a continued downward movement from its recent high at 1.3654, reaching as low as 1.3320 and breaking below the 1.3340 support level. Currently, the pair is facing a critical support level at 1.3300, which will be closely watched by traders.

There is a possibility of further decline in the near term, and a breakdown below the 1.3300 support level could open the door for a continuation of the downward move. In such a scenario, the next support level to monitor would be at 1.3260. Traders should be cautious as the downside momentum persists.

On the other hand, if the 1.3300 support level holds, we may see a short-term consolidation or a potential bounce in the price. In this case, the nearest resistance level to monitor is at 1.3410. A breakout above this level could indicate a temporary halt to the downside movement and could lead to a test of the 1.3461 resistance level. A decisive breakthrough above 1.3461 would suggest that the downside movement from 1.3654 has completed at 1.3320, potentially paving the way for another rise towards the previous high at 1.3654.

Traders should closely follow the price action and monitor key support and resistance levels for potential trading opportunities. It is important to consider other technical indicators, market sentiment, and fundamental factors that may influence the USDCAD pair.

To summarize, USDCAD continues its downward movement, testing key support levels. A breakdown below 1.3300 could lead to further decline, while a hold above this level may trigger a short-term consolidation or potential bounce. Traders should closely monitor price developments and consider other market factors to make informed trading decisions.