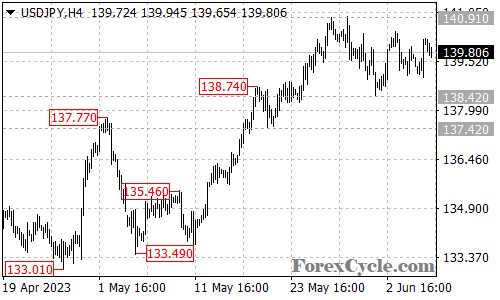

The USDJPY currency pair has been trading within a defined range between the support level at 138.42 and the resistance level at 140.91. This range-bound price action indicates a period of consolidation for the uptrend that started from 133.49.

Traders should closely monitor the support level at 138.42, as long as it holds, the price action within the range can be considered as consolidation. In such a scenario, a breakout above the resistance level at 140.91 could potentially trigger a further upside move towards the 142.00 area. A decisive breach of this resistance level would signify a continuation of the upward momentum.

However, if the support level at 138.42 is broken, it would suggest that the upside move from 133.49 has potentially completed at the resistance level of 140.91. In this case, another downward move towards the support level at 135.00 could be expected.

Traders should exercise caution and wait for a clear breakout or support breakdown before taking any significant trading positions. It is important to consider other technical indicators, market sentiment, and fundamental factors that may influence the USDJPY pair.

In summary, USDJPY is currently trading within a range between 138.42 and 140.91, indicating a consolidation phase for the recent uptrend. Traders should watch for a breakout above the resistance level or a breakdown below the support level to determine the next directional move. Remain informed, adapt to market conditions, and implement appropriate risk management strategies to navigate the USDJPY market effectively.