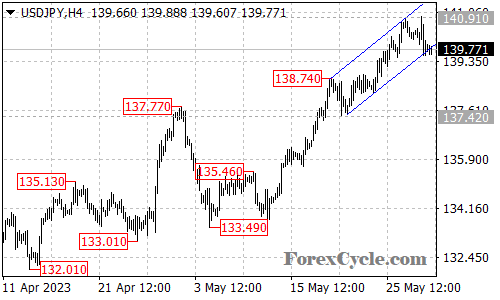

The USDJPY currency pair has recently broken below its rising price channel on the 4-hour chart, indicating a shift in momentum. This breakdown suggests that a deeper decline may be in store for the pair, with the next potential target around the 138.60 area. As long as this support level holds, the pullback from the recent high of 140.91 could be considered a consolidation phase within the broader uptrend from 133.49.

Traders and investors will closely monitor the price action around the 138.60 support level for further clues regarding the pair’s next move. A bounce from this level could indicate that the uptrend is still intact, potentially leading to another rise towards the 142.50 area after the consolidation is completed.

However, if the 138.60 support level is convincingly broken, it would suggest that the recent high at 140.91 marks a potential completion of the uptrend. In such a scenario, the pair may experience another decline towards the psychological support level at 135.00.

In summary, the USDJPY currency pair has broken below its rising price channel on the 4-hour chart, indicating a potential for a deeper decline towards the 138.60 support level. While the pullback from the recent high may be a consolidation phase, a breakdown below 138.60 could signal the completion of the uptrend and pave the way for a further fall towards 135.00. Traders should closely monitor price action and key levels to make informed trading decisions, considering both technical analysis and fundamental factors.